Business, 18.11.2019 20:31 PatienceJoy

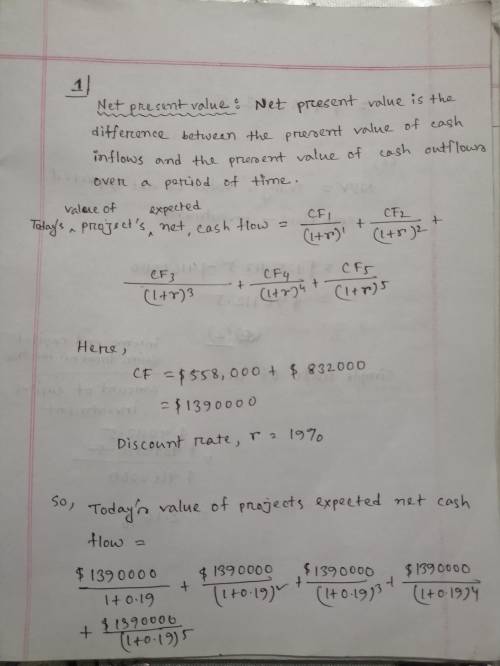

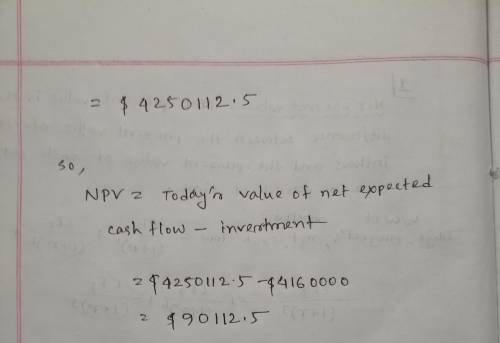

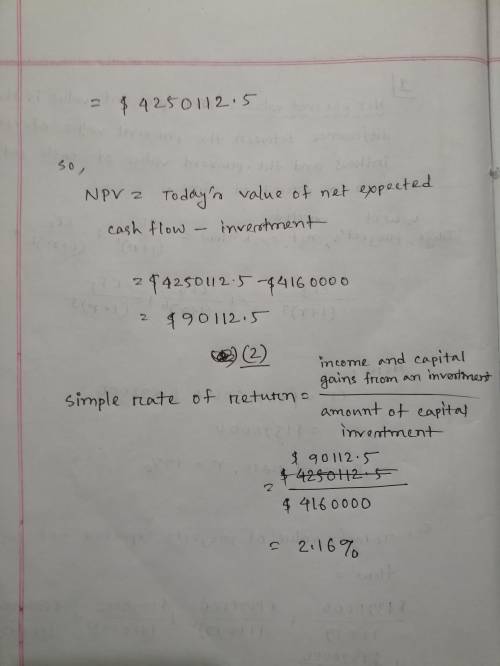

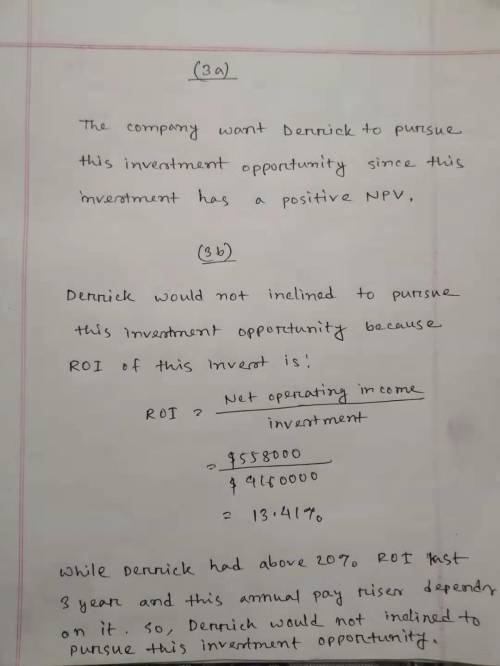

Derrick iverson is a divisional manager for holston company. his annual pay raises are largely determined by his division’s return on investment (roi), which has been above 20% each of the last three years. derrick is considering a capital budgeting project that would require a $4,160,000 investment in equipment with a useful life of five years and no salvage value. holston company’s discount rate is 19%. the project would provide net operating income each year for five years as follows: sales $ 3,700,000 variable expenses 1,600,000 contribution margin 2,100,000 fixed expenses: advertising, salaries, and other fixed out-of-pocket costs $ 710,000 depreciation 832,000 total fixed expenses 1,542,000 net operating income $ 558,000 click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables. required: 1. compute the project's net present value. 2. compute the project's simple rate of return. 3a. would the company want derrick to pursue this investment opportunity? 3b. would derrick be inclined to pursue this investment opportunity?

Answers: 1

Another question on Business

Business, 22.06.2019 00:50

Consider each of the following cases: case accounting break-even unit price unit variable cost fixed costs depreciation 1 127,400 $ 38 $ 25 $ 711,000 ? 2 124,000 ? 41 2,500,000 $ 900,000 3 5,753 117 ? 171,000 100,000 required: (a) find the depreciation for case 1. (do not round your intermediate calculations.) (b) find the unit price for case 2. (do not round your intermediate calculations.) (c) find the unit variable cost for case 3. (do not round your intermediate calculations.)

Answers: 2

Business, 22.06.2019 11:00

Companies hd and ld are both profitable, and they have the same total assets (ta), total invested capital, sales (s), return on assets (roa), and profit margin (pm). both firms finance using only debt and common equity. however, company hd has the higher total debt to total capital ratio. which of the following statements is correct? a) company hd has a higher assets turnover than company ld. b) company hd has a higher return on equity than company ld. c) none of the other statements are correct because the information provided on the question is not enough. d) company hd has lower total assets turnover than company ld. e) company hd has a lower operating income (ebit) than company ld

Answers: 2

Business, 22.06.2019 13:50

When used-car dealers signal the quality of a used car with a warranty, a. buyers believe the signal because the cost of a false signal is high b. it is not rational to believe the signal because some used-car dealers are crooked c. the demand for lemons is eliminated d. the price of a lemon rises above the price of a good used car because warranty costs on lemons are greater than warranty costs on good used cars

Answers: 2

Business, 22.06.2019 20:00

Acompetitive market in healthcare would a. overprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers b. underprovide healthcare because it would eliminate medicare and medicaid c. underprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers d. overprovide healthcare because it would be similar to the approach used in canada

Answers: 1

You know the right answer?

Derrick iverson is a divisional manager for holston company. his annual pay raises are largely deter...

Questions

Social Studies, 31.08.2019 08:30

Chemistry, 31.08.2019 08:30

Biology, 31.08.2019 08:30

Social Studies, 31.08.2019 08:30

World Languages, 31.08.2019 08:30

Physics, 31.08.2019 08:30

History, 31.08.2019 08:30

Mathematics, 31.08.2019 08:30

Mathematics, 31.08.2019 08:30

Mathematics, 31.08.2019 08:30

Chemistry, 31.08.2019 08:30