Business, 19.11.2019 23:31 juansantos7b

Tim, a single taxpayer, operates a business as a single-member llc. in 2018, his llc reports business income of $394,000 and business deductions of $689,500, resulting in a loss of $295,500. what are the implications of this business loss?

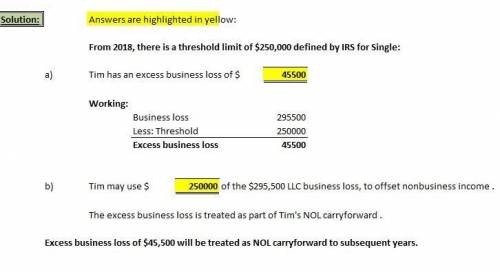

tim has an excess business loss of $

can this business loss be used to offset other income that tim reports? if so, how much? if not, what happens to the loss?

tim may use $ of the $295,500 llc business loss, to offset nonbusiness income . the excess business loss is treated as part of tim's nol carryforward .

Answers: 1

Another question on Business

Business, 22.06.2019 17:00

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 19:00

What is an equation of the line in slope intercept formm = 4 and the y-intercept is (0,5)y = 4x-5y = -5x +4y = 4x + 5y = 5x +4

Answers: 1

Business, 22.06.2019 19:40

Adistinguishing feature of ecological economics is the concept of cost-benefit analysis steady-state economies that, like natural systems, neither grow nor shrink environmental damage and also environmental benefits are external greenwashing to increase public acceptance of products the only healthy economy is one that is growing

Answers: 1

Business, 22.06.2019 22:50

For 2016, gourmet kitchen products reported $22 million of sales and $19 million of operating costs (including depreciation). the company has $15 million of total invested capital. its after-tax cost of capital is 10%, and its federal-plus-state income tax rate was 36%. what was the firm’s economic value added (eva), that is, how much value did management add to stockholders’ wealth during 2016?

Answers: 1

You know the right answer?

Tim, a single taxpayer, operates a business as a single-member llc. in 2018, his llc reports busines...

Questions

Mathematics, 01.03.2021 23:10

English, 01.03.2021 23:10

Social Studies, 01.03.2021 23:10

Mathematics, 01.03.2021 23:10

Mathematics, 01.03.2021 23:10

Health, 01.03.2021 23:10

Mathematics, 01.03.2021 23:10