Business, 21.11.2019 04:31 ewalchloe5067920

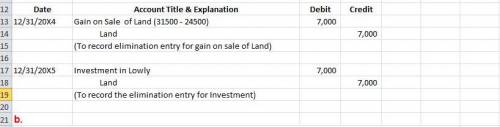

Huckster corporation purchased land on january 1, 20x1, for $24,500. on june 10, 20x4, it sold the land to its subsidiary, lowly corporation, for $31,500. huckster owns 60 percent of lowly’s voting shares. required: a. prepare the worksheet consolidation entries needed to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20x4 and 20x5. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field.)*record the consolidating entry on december 31, 20x4.*record the consolidating entry on december 31, 20x5.b. prepare the worksheet consolidation entries needed on december 31, 20x4 and 20x5, if lowly had initially purchased the land for $24,500 and then sold it to huckster on june 10, 20x4, for $31,500. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field.)*record the consolidating entry on december 31, 20x4.*record the consolidating entry on december 31, 20x5.

Answers: 1

Another question on Business

Business, 22.06.2019 00:30

What are six resources for you decide which type of business to start and how to start it?

Answers: 3

Business, 22.06.2019 20:00

What is the difference between total utility and marginal utility? a. marginal utility is subject to the law of diminishing marginal utility while total utility is not. b. total utility represents the consumer optimum while marginal utility gives the total utility per dollar spent on the last unit. c. total utility is the total amount of satisfaction derived from consuming a certain amount of a good while marginal utility is the additional satisfaction gained from consuming an additional unit of the good. d. marginal utility represents the consumer optimum while total utility gives the total utility per dollar spent on the last unit.

Answers: 3

Business, 23.06.2019 02:20

Which one of the following is not a typical current liability? a. interest payable b. current maturities of long-term debt c. salaries payable d. mortgages payable

Answers: 3

You know the right answer?

Huckster corporation purchased land on january 1, 20x1, for $24,500. on june 10, 20x4, it sold the l...

Questions

Mathematics, 18.10.2021 22:30

Biology, 18.10.2021 22:30

Mathematics, 18.10.2021 22:30

Mathematics, 18.10.2021 22:30

Mathematics, 18.10.2021 22:30

World Languages, 18.10.2021 22:40