Southern corporation has a capital structure of 40% debt and 60% common equity. this capital structure is expected not to change. the firm's tax rate is 34%. the firm can issue the following securities to finance capital investments:

debt: capital can be raised through bank loans at a pretax cost of 8.5%. also, bonds can be issued at a pretax cost of 10%.

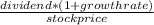

common stock: retained earnings will be available for investment. in addition, new common stock can be issued at the market price of $59. flotation costs will be $3 per share. the recent common stock dividend was $3.15. dividends are expected to grow at 7% in the future.

what is the cost of capital if the firm uses bank loans and retained earnings?

a. 9.9%

b. 10.3%

c. 12.6%

d. 11.8%

e. 10.4%

Answers: 2

Another question on Business

Business, 22.06.2019 18:30

What historical context does wiesel convey using the allusion of a fiery sky? he compares the sky to hell. the fires from air raids during world war ii the cremation of jews in the concentration camps the outbreak of forest fires from bombs in world war ii

Answers: 1

Business, 22.06.2019 19:40

On april 1, santa fe, inc. paid griffith publishing company $2,448 for 36-month subscriptions to several different magazines. santa fe debited the prepayment to a prepaid subscriptions account, and the subscriptions started immediately. what amount should appear in the prepaid subscription account for santa fe, inc. after adjustments on december 31 of the first year assuming the company is using a calendar-year reporting period and no previous adjustment has been made?

Answers: 1

Business, 22.06.2019 20:30

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

You know the right answer?

Southern corporation has a capital structure of 40% debt and 60% common equity. this capital structu...

Questions

Biology, 05.05.2020 12:35

Mathematics, 05.05.2020 12:35

English, 05.05.2020 12:35

Mathematics, 05.05.2020 12:35

History, 05.05.2020 12:35

Mathematics, 05.05.2020 12:35

History, 05.05.2020 12:35

Biology, 05.05.2020 12:35

Mathematics, 05.05.2020 12:35

Computers and Technology, 05.05.2020 12:35

+ growth rate ........................1

+ growth rate ........................1 + 0.07

+ 0.07