Business, 21.11.2019 06:31 villatoroo84502

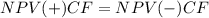

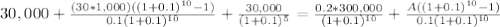

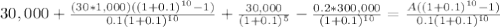

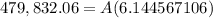

Adozer cost $300,000 to purchase, and the machine useful life is 10 years and 10,000 operating hours. the salvage value of the equipment at the end of 10 years is 20% of the purchase price. the maintenance cost for the equipment is $30 per operating hour. a major engine repair is expected in 5 years for $30,000. if the company cost of capital rate is 10%, how much should the owner of the machine charge per hour of use if the machine is expected to operate 1,000 hours per year?

Answers: 1

Another question on Business

Business, 22.06.2019 05:10

1. the political environment in india has proven to be critical to company performance for both pepsico and coca-cola india. what specific aspects of the political environment have played key roles? could these effects have been anticipated prior to market entry? if not, could developments in the political arena have been handled better by each company? 2. timing of entry into the indian market brought different results for pepsico and coca-cola india. what benefits or disadvantages accrued as a result of earlier or later market entry? 3. the indian market is enormous in terms of population and geography. how have the two companies responded to the sheer scale of operations in india in terms of product policies, promotional activities, pricing policies, and distribution arrangements? 4. “global localization” (glocalization) is a policy that both companies have implemented successfully. give examples for each company from the case.

Answers: 1

Business, 22.06.2019 15:30

Susan is a 5th grade teacher and loves getting up every day and going to work to teach her students. this is an example of a. extrinsic value b. interests c. intrinsic value d. external value

Answers: 2

Business, 22.06.2019 19:40

The following cost and inventory data are taken from the accounting records of mason company for the year just completed: costs incurred: direct labor cost $ 90,000 purchases of raw materials $ 134,000 manufacturing overhead $ 205,000 advertising expense $ 45,000 sales salaries $ 101,000 depreciation, office equipment $ 225,000 beginning of the year end of the year inventories: raw materials $ 8,100 $ 10,300 work in process $ 5,900 $ 21,000 finished goods $ 77,000 $ 25,800 required: 1. prepare a schedule of cost of goods manufactured. 2. prepare the cost of goods sold section of mason company’s income statement for the year.

Answers: 3

Business, 22.06.2019 19:50

On july 7, you purchased 500 shares of wagoneer, inc. stock for $21 a share. on august 1, you sold 200 shares of this stock for $28 a share. you sold an additional 100 shares on august 17 at a price of $25 a share. the company declared a $0.95 per share dividend on august 4 to holders of record as of wednesday, august 15. this dividend is payable on september 1. how much dividend income will you receive on september 1 as a result of your ownership of wagoneer stock

Answers: 1

You know the right answer?

Adozer cost $300,000 to purchase, and the machine useful life is 10 years and 10,000 operating hours...

Questions

Physics, 15.07.2019 15:30

Mathematics, 15.07.2019 15:30

Chemistry, 15.07.2019 15:30

History, 15.07.2019 15:30

Arts, 15.07.2019 15:30

World Languages, 15.07.2019 15:30

History, 15.07.2019 15:30

Mathematics, 15.07.2019 15:30

Mathematics, 15.07.2019 15:30

Mathematics, 15.07.2019 15:30