Business, 21.11.2019 06:31 angelhusted213

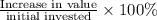

Greg initially invested $7,000 in a transportation company. the company recently paid annual dividends of $86 and his year-end investment value was $8,340. what was the rate of return on his investment? a. 22.00% b. 17.10% -c. 17.91% d. 20.37% e. 15.04%

Answers: 2

Another question on Business

Business, 22.06.2019 20:00

What is the difference between total utility and marginal utility? a. marginal utility is subject to the law of diminishing marginal utility while total utility is not. b. total utility represents the consumer optimum while marginal utility gives the total utility per dollar spent on the last unit. c. total utility is the total amount of satisfaction derived from consuming a certain amount of a good while marginal utility is the additional satisfaction gained from consuming an additional unit of the good. d. marginal utility represents the consumer optimum while total utility gives the total utility per dollar spent on the last unit.

Answers: 3

Business, 22.06.2019 21:20

1. what are the unique operational challenges to delivering fresh meals? 2. why is speed of delivery so important for delivered meals? what variety of options contribute to this performance metric? 3. how could operations management concepts be utilized to improve the performance of freshly? 4. what are your typical product delivery times? what would be required to speed these up? 5. what are your delivery batch quantities? how could you reduce batch size and reduce delivery cost simultaneously using operations management concepts?

Answers: 2

Business, 22.06.2019 22:10

Atoy store has a new game in stock, but customers aren't buying it. which of the following types of inventory increases when customers aren't buying this game? a. work-in-process b. raw materials c. finished goods d. in-transit

Answers: 3

Business, 23.06.2019 02:50

Ll companies has sales of $9,800, net income of $1,060, total assets of $8,950, and total debt of $4,760. assets and costs are proportional to sales. debt and equity are not. a dividend of $371 was paid, and the company wishes to maintain a constant payout ratio. next year's sales are projected to be $10,584. what is the amount of the external financing need?

Answers: 3

You know the right answer?

Greg initially invested $7,000 in a transportation company. the company recently paid annual dividen...

Questions

Mathematics, 06.05.2020 00:13

Mathematics, 06.05.2020 00:13

Mathematics, 06.05.2020 00:13

Chemistry, 06.05.2020 00:13

Biology, 06.05.2020 00:13

Mathematics, 06.05.2020 00:13