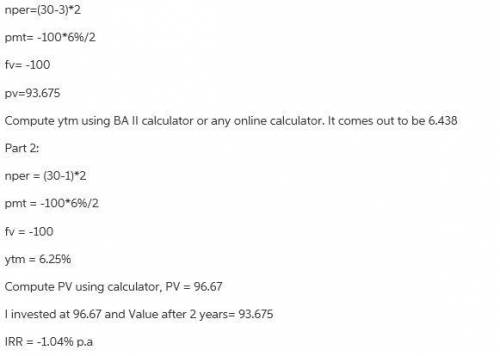

Three years ago, english and co. issued 30-year 6% coupon bonds. at the time of issuance, the yield to maturity was 6% per year and the bonds sold at face value. the bonds are currently selling at $93.675 per $100 of face value. assuming the coupon is paid semi-annually, what is the current yield to maturity? suppose you purchased these bonds one year after they were issued when they were priced to yield 6.25%. what has been your annualized rate of return on your investment? if you lack sufficient time to determine a numerical answer explain in detail the approach you would use to determine the investment's realized rate of return.

Answers: 1

Another question on Business

Business, 22.06.2019 08:30

Conor is 21 years old and just started working after college. he has opened a retirement account that pays 2.5% interest compounded monthly. he plans on making monthly deposits of $200. how much will he have in the account when he reaches 591 years of age?

Answers: 2

Business, 22.06.2019 09:40

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 22.06.2019 18:30

Health insurance protects you if you experience any of the following except: a: if you have to be hospitalized b: if you damage someone's property c: if you need to visit a clinic d: if you can't work because of illness

Answers: 2

Business, 22.06.2019 20:10

Russell's is considering purchasing $697,400 of equipment for a four-year project. the equipment falls in the five-year macrs class with annual percentages of .2, .32, .192, .1152, .1152, and .0576 for years 1 to 6, respectively. at the end of the project the equipment can be sold for an estimated $135,000. the required return is 13.2 percent and the tax rate is 23 percent. what is the amount of the aftertax salvage value of the equipment assuming no bonus depreciation is taken

Answers: 2

You know the right answer?

Three years ago, english and co. issued 30-year 6% coupon bonds. at the time of issuance, the yield...

Questions

Mathematics, 27.03.2020 20:21

Mathematics, 27.03.2020 20:22

Mathematics, 27.03.2020 20:22

Mathematics, 27.03.2020 20:22

Mathematics, 27.03.2020 20:22

Mathematics, 27.03.2020 20:22

Mathematics, 27.03.2020 20:22

Social Studies, 27.03.2020 20:22

Mathematics, 27.03.2020 20:22

Chemistry, 27.03.2020 20:22