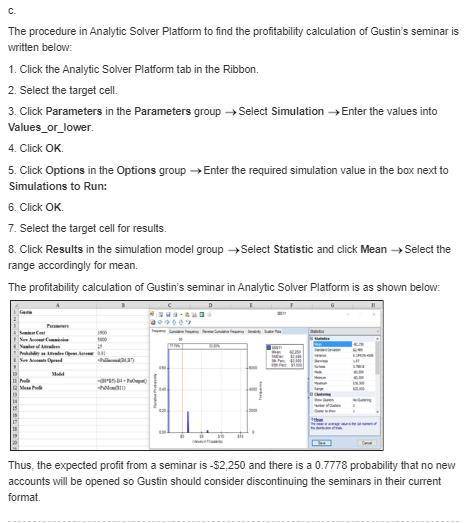

To generate leads for new business, gustin investment services offers free financial planning seminars at major hotels in southwest florida. gustin conducts seminars for groups of 25 individuals. each seminar costs gustin $3,600 and the average first-year commission for each new account opened is $5,600. gustin estimates that for each individual attending the seminar, there is a 0.01 probability that he/she will open a new account. a. determine the equation for computing gustin’s profit per seminar, given values of the relevant parameters. b. what type of random variable is the number of new accounts opened? (hint: review appendix 11.2 for descriptions of various types of probability distributions.)c. construct a spreadsheet simulation model to analyze the profitability of gustin’s seminars. would you recommend that gustin continue running the seminars? d. how large of an audience does gustin need before a seminar’s expected profit is greater than zero?

Answers: 2

Another question on Business

Business, 22.06.2019 08:40

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

Business, 22.06.2019 10:00

You are president of a large corporation. at a typical monthly meeting, each of your vice presidents gives standard area reports. in the past, these reports have been good, and the vps seem satisfied about their work. based on situational approach to leadership, which leadership style should you exhibit at the next meeting?

Answers: 2

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

Business, 22.06.2019 20:30

1. what is the lowest balance during this period? 2. lily just received her bank statement below. a. what does the bank think her ending balance is? b. how much more does the bank think lily has? c. what transactions are missing? 3. what is the danger of not balancing your bank account? lily’s bank statement deposits: 2/25 $35 2/26 $20 3/1 $256.32 checks: 2/24 ck #301 $25 2/26 #302 $150 debit card: 2/24 american eagle $75.48 2/25 chick fa la $4.67 2/27 mcdonalds $3.56 2/28 chevron $34.76 withdrawal: 2/27 $40 beginning balance $423.34 deposits $311.32 total debits $333.47 ending balance $401.19

Answers: 1

You know the right answer?

To generate leads for new business, gustin investment services offers free financial planning semina...

Questions

Mathematics, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00

History, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00

Mathematics, 13.03.2021 01:00