The rivoli company has no debt outstanding, and its financial position is given by the following data:

assets (book = market) 300,000

ebit 500,000,

cost of equity, rs 10%

stock price, po $15

shares outstanding, no 200,000

tax rate, t 40%

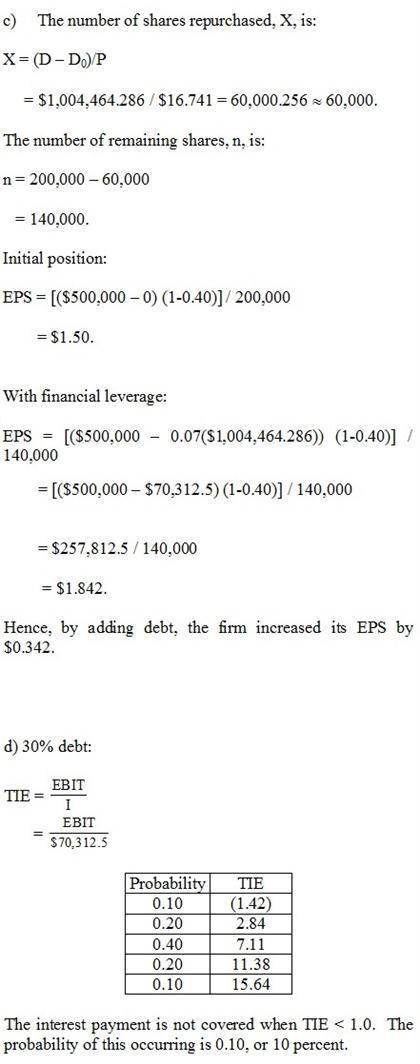

the firm is considering selling bonds and simultaneously repurchasing some of its stock. if it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 11% to reflect the increased risk. bonds can be sold at a cost rd of 7%. rivoli is a no growth firm. hence, all its earnings are paid out as dividends. earnings are expected to be constant over time.

a.) what effect would this use of leverage have on the value of the firm:

b.) what would be the price of rivoli’s stock?

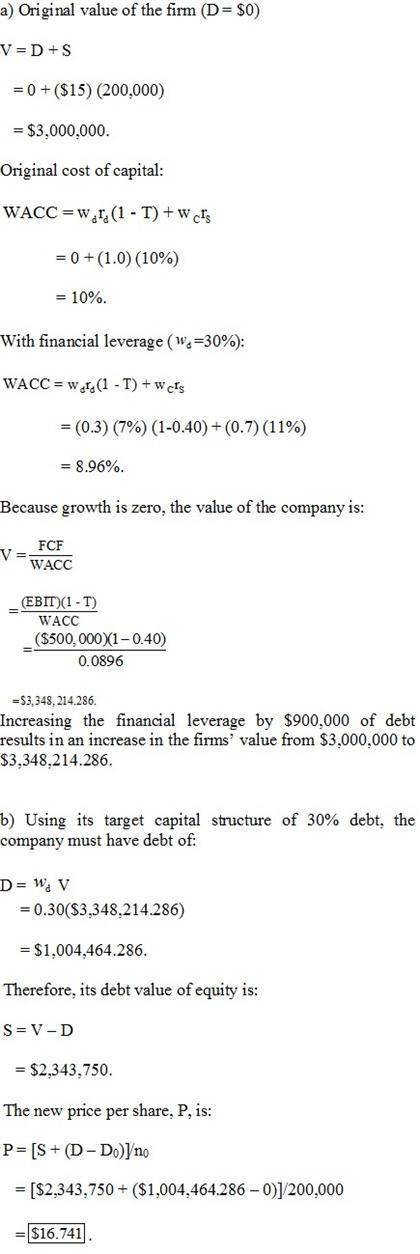

c.) what happens to the firm’s earnings per share after the recapitalization?

d.) the $500,000 ebit given previously is actually the expected value from the following probability distribution:

probability ebit

0.1 100,000

0.2 200,000

0.4 500,000

0.2 800,000

0.1 1,100,000

Answers: 2

Another question on Business

Business, 22.06.2019 10:50

Choose the statement that is incorrect. a. search activity occurs only in markets where there is a shortage. b. when a price is regulated and there is a shortage, search activity increases. c. the time spent looking for someone with whom to do business is called search activity. d. the opportunity cost of a good is equal to its price plus the value of the search time spent finding the good.

Answers: 3

Business, 22.06.2019 19:00

By 2020, automobile market analysts expect that the demand for electric autos will increase as buyers become more familiar with the technology. however, the costs of producing electric autos may increase because of higher costs for inputs (e.g., rare earth elements), or they may decrease as the manufacturers learn better assembly methods (i.e., learning by doing). what is the expected impact of these changes on the equilibrium price and quantity for electric autos?

Answers: 1

Business, 22.06.2019 19:00

Adrawback of short-term contracting as an alternative to making a component in-house is thata. it is the most-integrated alternative to performing an activity so the principal company has no control over the agent. b. the supplying firm has no incentive to make any transaction-specific investments to increase performance or quality. c. it fails to allow a long planning period that individual market transactions provide. d. the buying firm cannot demand lower prices due to the lack of a competitive bidding process.

Answers: 2

You know the right answer?

The rivoli company has no debt outstanding, and its financial position is given by the following dat...

Questions

Business, 05.06.2021 08:20

Computers and Technology, 05.06.2021 08:20

Social Studies, 05.06.2021 08:20

History, 05.06.2021 08:20

History, 05.06.2021 08:20

Mathematics, 05.06.2021 08:20

Social Studies, 05.06.2021 08:20

Mathematics, 05.06.2021 08:20

Mathematics, 05.06.2021 08:20

Biology, 05.06.2021 08:20

History, 05.06.2021 08:30

Mathematics, 05.06.2021 08:30

Mathematics, 05.06.2021 08:30

Biology, 05.06.2021 08:30