Business, 22.11.2019 01:31 iicekingmann

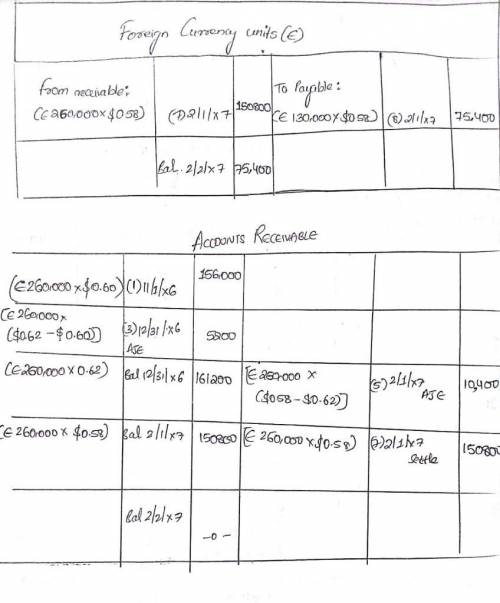

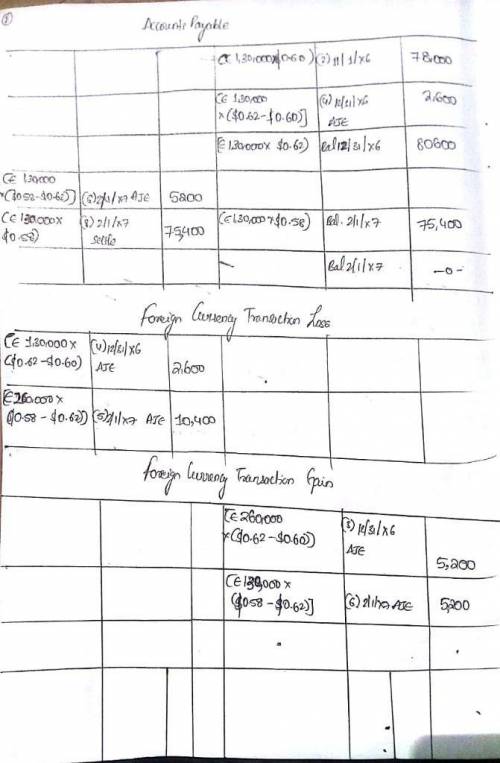

Merchant company had the following foreign currency transactions: on november 1, 20x6, merchant sold goods to a company located in munich, germany. the receivable was to be settled in european euros on february 1, 20x7, with the receipt of €190,000 by merchant company. on november 1, 20x6, merchant purchased machine parts from a company located in berlin, germany. merchant is to pay €95,000 on february 1, 20x7. the direct exchange rates are as follows: november 1, 20x6 €1 = $ 0.60 december 31, 20x6 €1 = $ 0.62 february 1, 20x7 €1 = $ 0.58 required: record the t-accounts for the following transactions (record the transactions in the given order.) the november 1, 20x6, export transaction (sale). the november 1, 20x6, import transaction (purchase). the december 31, 20x6, year-end adjustment required of the foreign currency–denominated receivable of €190,000. the december 31, 20x6, year-end adjustment required of the foreign currency–denominated payable of €95,000. the february 1, 20x7, adjusting entry to determine the u. s. dollar–equivalent value of the foreign currency receivable on that date. the february 1, 20x7, adjusting entry to determine the u. s. dollar–equivalent value of the foreign currency payable on that date. the february 1, 20x7, settlement of the foreign currency receivable. the february 1, 20x7, settlement of the foreign currency payable.

Answers: 3

Another question on Business

Business, 21.06.2019 22:20

Outstanding stock consists of 8,300 shares of cumulative 7% preferred stock with a $10 par value and 4,300 shares of common stock with a $1 par value. during the first three years of operation, the corporation declared and paid the following total cash dividends. year dividend declared 2016 $ 0 2017 $ 7,300 2018 $ 45,000 the amount of dividends paid to preferred and common shareholders in 2018 is:

Answers: 2

Business, 21.06.2019 23:00

Which of the following statements is correct? large corporations are taxed more favorably than sole proprietorships. corporate stockholders are exposed to unlimited liability. due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of u.s. businesses (in terms of number of businesses) are organized as corporations. most businesses (by number and total dollar sales) are organized as partnerships or proprietorships because it is easier to set up and operate in one of these forms rather than as a corporation. however, if the business gets very large, it becomes advantageous to convert to a corporation, mainly because corporations have important tax advantages over proprietorships and partnerships. most business (measured by dollar sales) is conducted by corporations in spite of large corporations’ often less favorable tax treatment, due to legal considerations related to ownership transfers and limited liability.

Answers: 3

Business, 21.06.2019 23:30

Select the correct answer. the word intestate means that a person has died with or without a will?

Answers: 1

Business, 22.06.2019 06:40

Burke enterprises is considering a machine costing $30 billion that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years. after 11 years, the company can sell the parts for $5 billion. burke has a target debt/equity ratio of 1.2, a beta of 1.79. you estimate that the return on the market is 7.5% and t-bills are currently yielding 2.5%. burke has two issuances of bonds outstanding. the first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, and maturity of 5 years. the second has 500,000 bonds trading at par, with coupons of 7.5%, face of $1000, and maturity of 12 years. kate, the ceo, usually applies an adjustment factor to the discount rate of +2 for such highly innovative projects. should the company take on the project?

Answers: 1

You know the right answer?

Merchant company had the following foreign currency transactions: on november 1, 20x6, merchant sol...

Questions

Mathematics, 16.12.2020 22:30

Chemistry, 16.12.2020 22:30

English, 16.12.2020 22:30

Social Studies, 16.12.2020 22:30

Health, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30

Biology, 16.12.2020 22:30

Mathematics, 16.12.2020 22:30