Business, 22.11.2019 23:31 angelica19carmona

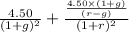

The border crossing just paid an annual dividend of $4.20 per share and is expected to pay annual dividends of $4.40 and $4.50 per share the next two years, respectively. after that, the firm expects to maintain a constant dividend growth rate of 2 percent per year. what is the value of this stock today if the required return is 14 percent?

a. $30.04

b. $32.18

c. $33.33

d. $35.80

e. $36.75.

Answers: 1

Another question on Business

Business, 21.06.2019 19:20

Anderson, a computer engineer, and spouse, who is unemployed, provide more than half of the support for their child, age 23, who is a full-time student and who earns $7,000. they also provide more than half of the support for their older child, age 33, who earns $2,000 during the year. how many dependents may the andersons claim on their joint tax return?

Answers: 3

Business, 22.06.2019 11:40

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x,y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

Business, 22.06.2019 16:40

Consider two similar industries, portal crane manufacturing (pcm) and forklift manufacturing (flm). the pcm industry has exactly three incumbents with annual sales of $800 million, $200 million and $100 million, respectively. the flm industry has also exactly three incumbents, with annual sales of $500 million, $450 million and $400 million, respectively. which industry is more likely to experience a higher level of rivalry?

Answers: 3

Business, 23.06.2019 01:30

What is the minimum educational requirement for a pediatric psychopharmacologist? a. md b. phd c. bachelors in medicine d. masters in medicine e. psyd

Answers: 3

You know the right answer?

The border crossing just paid an annual dividend of $4.20 per share and is expected to pay annual di...

Questions

Mathematics, 28.08.2020 20:01

Mathematics, 28.08.2020 20:01

French, 28.08.2020 20:01

Mathematics, 28.08.2020 20:01

History, 28.08.2020 20:01

Mathematics, 28.08.2020 20:01

Mathematics, 28.08.2020 20:01

+

+

+

+  +

+