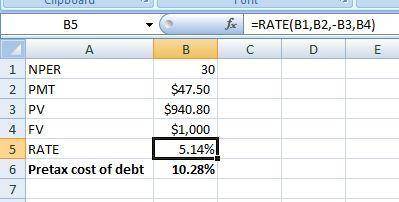

St. thomas company is planning to issue $1,000 par value bonds. the bonds will have a coupon rate of 9.5 percent and will be sold at a market price of $980. flotation costs will amount to 4 percent of market value. the bonds will mature in 15 years and coupon payments will be semi-annual. st. thomas' marginal tax rate is 35%. what is the firm's cost of debt financing?

a. 6.93%

b. 6.68%

c. 6.34%

d. 10.28%

e. 9.76%

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 09:30

What is the relationship among market segmentation, target markts, and consumer profiles?

Answers: 2

Business, 22.06.2019 20:20

Precision aviation had a profit margin of 6.25%, a total assets turnover of 1.5, and an equity multiplier of 1.8. what was the firm's roe? a. 15.23%b. 16.03%c. 16.88%d. 17.72%e. 18.60%

Answers: 2

Business, 22.06.2019 21:00

At present, the united states has an embargo against north korea because a. the two countries have extremely poor political relations. b. north korea will not adopt a capitalist government. c. north korean products are too difficult to use. d. north korea has an embargo on american products. e. products from north korea are in higher demand than american-made products.

Answers: 2

You know the right answer?

St. thomas company is planning to issue $1,000 par value bonds. the bonds will have a coupon rate of...

Questions

Mathematics, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Biology, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Computers and Technology, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31