Norma who is single and uses the cash method of accounting, lives in a state that imposes an income tax. in april 2019, she files her state income tax return for 2018 and pays an additional $1,000 in state income taxes. during 2019, her withholdings for state income tax purposes amount to $7,400, and she pays estimated state income tax of $700. in april 2020, she files her state income tax return for 2019, claiming a refund of $1,800. norma receives the refund in august 2020. norma has no other state or local tax expenses.

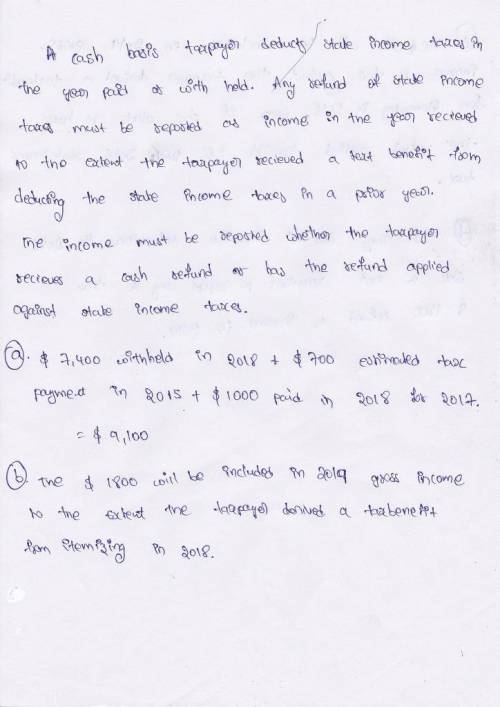

a. assuming that norma itemized deductions in 2019, how much may she claim as a deduction for state income taxes on her federal return for calendar year 2019 (filed april 2020)

b. assuming that norma itemized deductions in 2018 (which totaled $20,000), how will the refund of $1,800 that she received in 2019 be treated for federal income tax purposes?

norma will include $ as income in 2019.

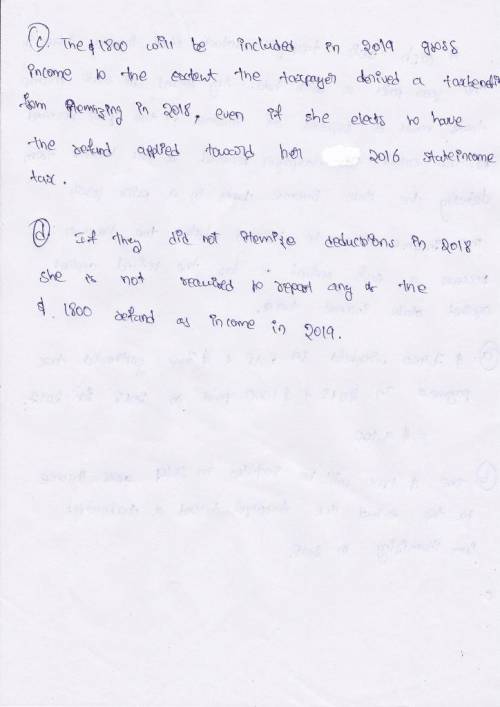

c. assume that norma itemized deductions in 2018 (which totaled $20,000) and that she elects to have the $1,800 refund applied toward her 2019 state income tax liability. how will the $1,800 be treated for federal income tax purposes?

norma will include $ income in 2019.

d. assuming that norma did not itemize deductions in 2018, how will the refund of $1,800 received in 2019 be treated for federal income tax purposes?

norma will include $ as income in 2019.

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

Acompany using the perpetual inventory system purchased inventory worth $540,000 on account with credit terms of 2/15, n/45. defective inventory of $40,000 was returned 2 days later, and the accounts were appropriately adjusted. if the company paid the invoice 20 days later, the journal entry to record the payment would be

Answers: 1

Business, 22.06.2019 17:30

Four students are at an extracurricular activity fair at their high school and are trying to decide which clubs to join. some information about the students is listed in this chart: which describes which ctso each student should join?

Answers: 1

Business, 22.06.2019 20:10

With signals from no-claim bonuses and deductibles, a. the marginal cost curve for careful drivers lies to the left of the marginal cost curve for aggressive drivers b. auto insurance companies insure more aggressive drivers than careful drivers because aggressive drivers have a greater need for the insurance c. the market for car insurance has a separating equilibrium, and the market is efficient d. most drivers pay higher premiums than if the market had no signals

Answers: 1

Business, 22.06.2019 21:50

scenario: hawaii and south carolina are trading partners. hawaii has an absolute advantage in the production of both coffee and tea. the opportunity cost of producing 1 pound of tea in hawaii is 2 pounds of coffee, and the opportunity cost of producing 1 pound of tea in south carolina is 1/3 pound of coffee. which of the following statements is true? a. south carolina should specialize in the production of both tea and coffee. b. hawaii should specialize in the production of tea, whereas south carolina should specialize in the production of coffee. c. hawaii should specialize in the production of coffee, whereas south carolina should specialize in the production of tea. d. hawaii should specialize in the production of both tea and coffee.

Answers: 1

You know the right answer?

Norma who is single and uses the cash method of accounting, lives in a state that imposes an income...

Questions

Mathematics, 14.02.2020 20:58

Mathematics, 14.02.2020 20:58

History, 14.02.2020 20:58

Health, 14.02.2020 20:58

History, 14.02.2020 20:58

History, 14.02.2020 20:58

Biology, 14.02.2020 20:58

Mathematics, 14.02.2020 20:58

Mathematics, 14.02.2020 20:58

Biology, 14.02.2020 20:58

English, 14.02.2020 20:58

Social Studies, 14.02.2020 20:58

History, 14.02.2020 20:58

Biology, 14.02.2020 20:58