Business, 26.11.2019 05:31 jamayeah02

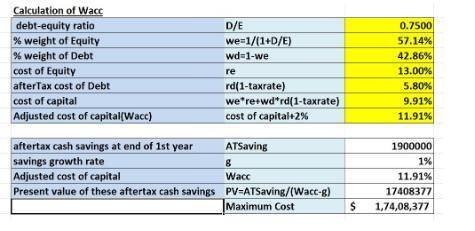

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.9 million at the end of the first year, and these savings will grow at a rate of 1 percent per year indefinitely. the firm has a target debt-equity ratio of .75, a cost of equity of 13 percent, and an aftertax cost of debt of 5.8 percent. the cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of 2 percent to the cost of capital for such risky projects. what is the maximum initial cost the company would be willing to pay for the project? (do not round intermediate calculations and enter your answer in dollars, not millions, rounded to the nearest whole dollar amount, e. g., 1,234,567.)

Answers: 2

Another question on Business

Business, 22.06.2019 14:00

The following costs were incurred in may: direct materials $ 44,800 direct labor $ 29,000 manufacturing overhead $ 29,300 selling expenses $ 26,800 administrative expenses $ 37,100 conversion costs during the month totaled:

Answers: 2

Business, 22.06.2019 21:30

Consider the following three bond quotes; a treasury note quoted at 87.25, and a corporate bond quoted at 102.42, and a municipal bond quoted at 101.45. if the treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? multiple choice $872.50, $1,000, $1,000, respectively $1,000, $1,024.20, $1,001.45, respectively $872.50, $1,024.20, $5,072.50, respectively $1,000, $1,000, $1,000, respectively

Answers: 3

Business, 22.06.2019 22:30

The answer here, x=7, is not in the interval that you selected in the previous part. what is wrong with the work shown above?

Answers: 1

Business, 23.06.2019 00:10

You are to receive five gold coins from your great uncle as an incentive to study hard. the coins were originally purchased in 1982. your great uncle will deliver the coins the week after finals (assuming your grades are "acceptable"). the amount your great uncle paid for the coins is a(n): indirect cost.overhead cost.opportunity cost.sunk cost.

Answers: 1

You know the right answer?

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.9 mil...

Questions

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00