Business, 26.11.2019 05:31 maddyclark19

On january 1, 2018, the general ledger of grand finale fireworks includes the following account balances:

accounts debit credit

cash $ 43,200

accounts receivable 45,500

supplies 8,000

equipment 69,000

accumulated depreciation $ 9,500

accounts payable 15,100

common stock, $1 par value 15,000

additional paid-in capital 85,000

retained earnings 41,100

totals $ 165,700 $ 165,700

during january 2018, the following transactions occur:

january 2 issue an additional 2,000 shares of $1 par value common stock for $40,000.

january 9 provide services to customers on account, $15,600.

january 10 purchase additional supplies on account, $5,400.

january 12 repurchase 1,200 shares of treasury stock for $17 per share.

january 15 pay cash on accounts payable, $17,000.

january 21 provide services to customers for cash, $49,600.

january 22 receive cash on accounts receivable, $17,100.

january 29 declare a cash dividend of $0.30 per share to all shares outstanding on january 29. the dividend is payable on february 15. (hint: grand finale fireworks had 15,000 shares outstanding on january 1, 2018 and dividends are not paid on treasury stock.)

january 30 reissue 800 shares of treasury stock for $19 per share.

january 31 pay cash for salaries during january, $42,500.

1. record each of the transactions listed above.

a. unpaid utilities for the month of january are $6,700.

b. supplies at the end of january total $5,600.

c. depreciation on the equipment for the month of january is calculated using the straight-line method. at the time the equipment was purchased, the company estimated a service life of three years and a residual value of $10,500.

d. accrued income taxes at the end of january are $2,500.

2. record the adjusting entries on january 31, 2018 for the above transactions.

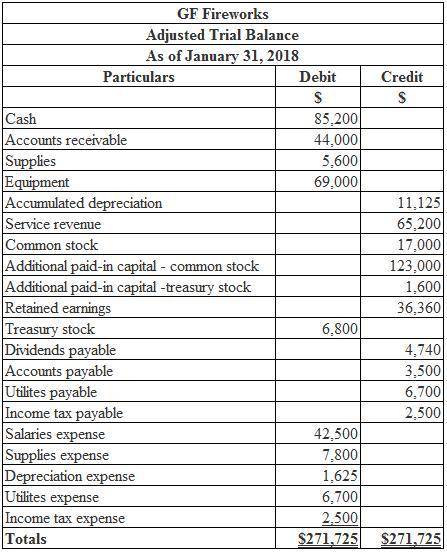

3. prepare an adjusted trial balance as of january 31, 2018.

4. prepare a multiple-step income statement for the period ended january 31, 2018.

5. prepare a classified balance sheet as of january 31, 2018.

on january 1, 2018, the general ledger of grand finale fireworks includes the following account balances: accounts debit credit cash $ 43,200 accounts receivable 45,500 supplies 8,000 equipment 69,000 accumulated depreciation $ 9,500 accounts payable 15,100 common stock, $1 par value 15,000 additional paid-in capital 85,000 retained earnings 41,100 totals $ 165,700 $ 165,700

Answers: 1

Another question on Business

Business, 21.06.2019 15:30

Jen heard that the bank where she kept her money was going to close for good. jen said she wasn't worried

Answers: 3

Business, 22.06.2019 06:30

Select all that apply. select the ways that labor unions can increase wages. collective bargaining reducing the labor supply increasing the demand for labor creating monopolies

Answers: 1

Business, 22.06.2019 11:00

Zoe would like to be able to save for night courses at the local college. which of these would be a good way for zoe to make more money available for savings without dramatically changing her budget? economía

Answers: 2

Business, 22.06.2019 12:00

Describe the three different ways the argument section of a cover letter can be formatted

Answers: 1

You know the right answer?

On january 1, 2018, the general ledger of grand finale fireworks includes the following account bala...

Questions

Mathematics, 22.01.2020 00:31

Computers and Technology, 22.01.2020 00:31

History, 22.01.2020 00:31

Biology, 22.01.2020 00:31

Social Studies, 22.01.2020 00:31

Chemistry, 22.01.2020 00:31

World Languages, 22.01.2020 00:31

History, 22.01.2020 00:31

Mathematics, 22.01.2020 00:31