Business, 26.11.2019 05:31 ryantrajean7

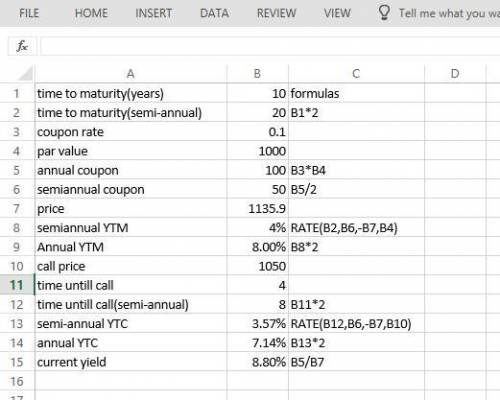

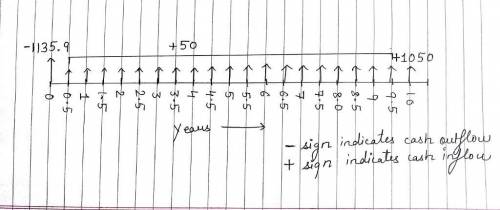

2) a 10-year, 10% semiannual coupon bond selling for $1,135.90 can be called in 4 years for $1,050 (hint: par value is $1,000). draw the time line? show your work what is its yield to maturity (ytm)? show your work what s its current yield (cy)? show your work what is its yield to call (ytc)? show your work.

Answers: 2

Another question on Business

Business, 22.06.2019 14:30

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Business, 22.06.2019 20:30

Almeda products, inc., uses a job-order costing system. the company's inventory balances on april 1, the start of its fiscal year, were as follows:

Answers: 2

Business, 23.06.2019 00:30

Emerson has an associate degree based on the chart below how will his employment opportunities change from 2008 to 2018

Answers: 2

Business, 23.06.2019 12:10

A. calculate the payoff and profit at expiration for the february 190 calls, if you purchase the option at the stated price and at expiration the stock price is $195. b. calculate the payoff and profit at expiration for the february 195 puts, if you purchase the option at the stated price and at expiration the stock price is $195.

Answers: 3

You know the right answer?

2) a 10-year, 10% semiannual coupon bond selling for $1,135.90 can be called in 4 years for $1,050 (...

Questions

Mathematics, 29.10.2020 20:20

Health, 29.10.2020 20:20

Mathematics, 29.10.2020 20:20

Mathematics, 29.10.2020 20:20

History, 29.10.2020 20:20

Mathematics, 29.10.2020 20:20

Mathematics, 29.10.2020 20:20

History, 29.10.2020 20:20

Spanish, 29.10.2020 20:20

Mathematics, 29.10.2020 20:20

English, 29.10.2020 20:20

Mathematics, 29.10.2020 20:20

Mathematics, 29.10.2020 20:20