Business, 26.11.2019 06:31 shenothomas688

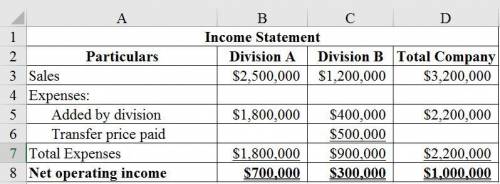

Division a manufactures electronic circuit boards. the boards can be sold either to division b of the same company or to outside customers. last year, the following activity occurred in division a: selling price per circuit board $125variable cost per circuit board $90number of circuit boards: produced during the year 20,000sold to outside customers 16,000sold to division b 4,000sales to division b were at the same price as sales to outside customers. the circuit boards purchased by division b were used in an electronic instrument manufactured by that division. (one board per instrument). division b incurred $100 in additional variable cost per instrument and then sold the instruments for $300 each. prepare income statements for division a, division b, and the company as a whole: division a division b total companysales $ $ $expenses: added by the divisiontransfer price paidtotal expensesnet operating income

Answers: 1

Another question on Business

Business, 21.06.2019 18:30

What is product differentiation, and how can it be achieved ? what is product positioning? what conditions would head to head product positioning be appropriate?

Answers: 2

Business, 22.06.2019 06:30

If the findings and the results are not presented properly, the research completed was a waste of time and money. true false

Answers: 1

Business, 22.06.2019 10:00

Cynthia is a hospitality worker in the lodging industry who prefers to cater to small groups of people. she might want to open a

Answers: 3

Business, 22.06.2019 19:30

Each row in a database is a set of unique information called a(n) table. record. object. field.

Answers: 3

You know the right answer?

Division a manufactures electronic circuit boards. the boards can be sold either to division b of th...

Questions

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Chemistry, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00

Mathematics, 29.11.2021 01:00