Business, 26.11.2019 19:31 brevenb375

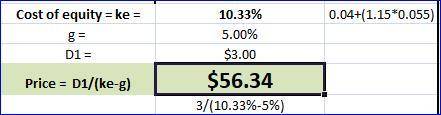

The edward company is expected to pay a dividend of d1 = $3.00 per share at the end of the year, and that dividend is expected to grow at a constant rate of 5.00% per year in the future. the company's beta is 1.15, the market risk premium is 5.50%, and the risk-free rate is 4.00%. what is the company's current stock price?

Answers: 2

Another question on Business

Business, 22.06.2019 10:00

Your uncle is considering investing in a new company that will produce high quality stereo speakers. the sales price would be set at 1.5 times the variable cost per unit; the variable cost per unit is estimated to be $75.00; and fixed costs are estimated at $1,200,000. what sales volume would be required to break even, i.e., to have ebit = zero?

Answers: 1

Business, 22.06.2019 20:00

If an investment has 35 percent more nondiversifiable risk than the market portfolio, its beta will be:

Answers: 1

Business, 22.06.2019 20:40

David consumes two things: gasoline (g) and bread (b). david's utility function is u(g, b) = 10g^0.25 b^0.75. use the lagrange technique to solve for david's optimal choices of gasoline and bread as a function of the price of gasoline, p_g, the price of bread, p_b, and his income m. with recent decrease in the price of gasoline (maybe due to external shock such as shale gas production) does david increase his consumption of gasoline? for david, how does partial differential g/partial differential p_g depend on his income m? that is, how does david's change in gasoline consumption due to an increase in the price of gasoline depend on his income level? to answer these questions, find the cross-partial derivative, |partial differential^2 g/partial differential m partial differential p_g.

Answers: 1

You know the right answer?

The edward company is expected to pay a dividend of d1 = $3.00 per share at the end of the year, and...

Questions

Mathematics, 15.01.2021 02:00

Mathematics, 15.01.2021 02:00

English, 15.01.2021 02:00

Mathematics, 15.01.2021 02:00

English, 15.01.2021 02:00

Chemistry, 15.01.2021 02:00

English, 15.01.2021 02:00

Mathematics, 15.01.2021 02:00

Mathematics, 15.01.2021 02:00

Mathematics, 15.01.2021 02:00