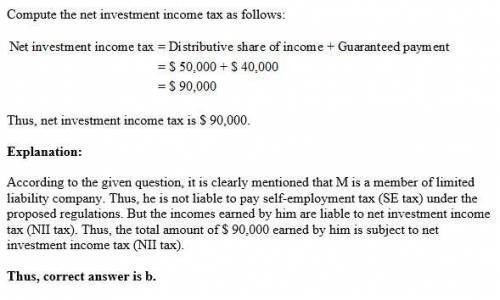

Meredith is a passive 30% member of the mno llc. she is not a managing member and she does not participate in any activities of the llc. her interest is more in the nature of an investment. in the current year, meredith's distributive share of income from the llc was $50,000. in addition, she received a guaranteed payment of $40,000 for the use of her capital. assume that her income from other sources exceeds $500,000. how much of meredith's llc income will be subject to the self-employment (se) tax (under the proposed regulations) and the net investment income (nii) tax? (disregard the additional medicare tax on upper-income taxpayers.)a.$90,000 se tax; $0 nii tax. b.$0 se tax; $90,000 nii tax. c.$50,000 se tax; $40,000 nii tax. d.$0 se tax; $0 nii tax. e.$0 se tax; $40,000 nii tax.

Answers: 3

Another question on Business

Business, 21.06.2019 21:10

Of the roles commonly found in the development, maintenance, and compliance efforts related to a policy and standards library, which of the following has the responsibilities of directing policies and procedures designed to protect information resources, identifying vulnerabilities, and developing a security awareness program?

Answers: 3

Business, 22.06.2019 21:00

Suppose either computers or televisions can be assembled with the following labor inputs: units produced 1 2 3 4 5 6 7 8 9 10 total labor used 3 7 12 18 25 33 42 54 70 90 (a) draw the production possibilities curve for an economy with 54 units of labor. label it p54. (b) what is the opportunity cost of the eighth computer? (c) suppose immigration brings in 36 more workers. redraw the production possibilities curve to reflect this added labor. label the new curve p90.

Answers: 2

Business, 23.06.2019 02:50

Dakota company experienced the following events during 2016. 1. acquired $30,000 cash from the issue of common stock. 2. paid $12,000 cash to purchase land. 3. borrowed $10,000 cash. 4. provided services for $20,000 cash. 5. paid $1,000 cash for utilities expense. 6. paid $15,000 cash for other operating expenses. 7. paid a $2,000 cash dividend to the stockholders. 8. determined that the market value of the land purchased in event 2 is now $12,700

Answers: 1

Business, 23.06.2019 18:30

At december 31, 2018, newman engineering’s liabilities include the following: $29 million of 5% bonds were issued for $29 million on may 31, 1999. the bonds mature on may 31, 2029, but bondholders have the option of calling (demanding payment on) the bonds on may 31, 2019. however, the option to call is not expected to be exercised, given prevailing market conditions. $33 million of 4% notes are due on may 31, 2022. a debt covenant requires newman to maintain current assets at least equal to 194% of its current liabilities. on december 31, 2018, newman is in violation of this covenant. newman obtained a waiver from national city bank until june 2019, having convinced the bank that the company’s normal 2 to 1 ratio of current assets to current liabilities will be reestablished during the first half of 2019. $26 million of 7% bonds were issued for $26 million on august 1, 1989. the bonds mature on july 31, 2019. sufficient cash is expected to be available to retire the bonds at maturity. required: classify the above mentioned debts as current liabilities or noncurrent liabilities. also, provide corresponding value for the same. (enter your answer in millions (i.e., 10,000,000 should be entered as

Answers: 2

You know the right answer?

Meredith is a passive 30% member of the mno llc. she is not a managing member and she does not parti...

Questions

Mathematics, 15.04.2020 19:15

Mathematics, 15.04.2020 19:15

English, 15.04.2020 19:15

Mathematics, 15.04.2020 19:15

Social Studies, 15.04.2020 19:15

Mathematics, 15.04.2020 19:15

Chemistry, 15.04.2020 19:15

Mathematics, 15.04.2020 19:15

Mathematics, 15.04.2020 19:15

History, 15.04.2020 19:15

Mathematics, 15.04.2020 19:15