Business, 27.11.2019 00:31 adwinajames

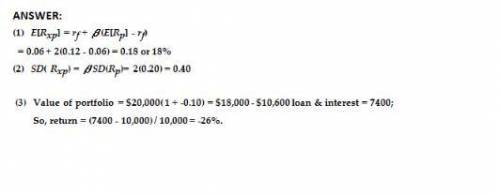

Suppose you have $10,000 in cash and you decide to borrow another $10,000 at a 6% interest rate to invest in the stock market. you invest the entire $20,000 in an exchange traded fund (etf) with a 12% expected return and a 20% volatility. 7) the expected return on your of your investment is closest to: expected return of your investment = (2*1.12 – 1*1.06) / 1 – 1 = 18% 8) the volatility of your of your investment is closest to: 9) assume that the eft you invested in returns -10%, then the realized return on your investment is closest to:

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

Peninsula products has just applied for a loan at your bank. when reviewing peninsula's books for the year that just ended, you notice that the firm uses the fair value option for its bonds payable. you also see that the firm recorded a $55,000 debit in its bonds payable account and a $55,000 credit in its unrealized holding gain or loss"income account. over that same period, interest rates decreased by about 0.5 percent. how should this information affect the bank's decision as to whether to grant peninsula a loan? a : the bank should strongly consider giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen an increase in its credit rating over the past year. b : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely the result of the rise in interest rates. c : the bank should hesitate before giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen a decline in its credit rating over the past year. d : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely unrelated to either interest rates or the firm's credit rating.

Answers: 2

Business, 22.06.2019 08:20

How much does a neurosurgeon can make most in canada? give me answer in candian dollar

Answers: 1

Business, 22.06.2019 20:40

Which of the following would indicate an improvement in a company's financial position, holding other things constant? a. the inventory and total assets turnover ratios both decline.b. the debt ratio increases.c. the profit margin declines.d. the times-interest-earned ratio declines.e. the current and quick ratios both increase.

Answers: 3

Business, 22.06.2019 22:00

What legislation increased the ability for federal authorities to tap telephones and wireless devices, tightened the enforcement of money laundering activities, as well as broadened powers toward acts of terrorism and acts such as drug trafficking?

Answers: 2

You know the right answer?

Suppose you have $10,000 in cash and you decide to borrow another $10,000 at a 6% interest rate to i...

Questions

Mathematics, 28.10.2020 05:50

History, 28.10.2020 05:50

Mathematics, 28.10.2020 05:50

Mathematics, 28.10.2020 05:50

Mathematics, 28.10.2020 05:50

History, 28.10.2020 05:50

Spanish, 28.10.2020 05:50

English, 28.10.2020 05:50

Law, 28.10.2020 05:50

Mathematics, 28.10.2020 05:50

English, 28.10.2020 05:50