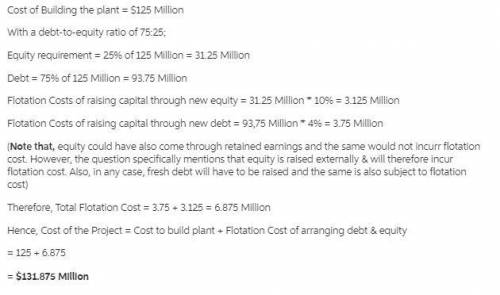

Medina corp. has a debt-equity ratio of .75. the company is considering a new plant that will cost $125 million to build. when the company issues new equity, it incurs a flotation cost of 10 percent. the flotation cost on new debt is 4 percent. what is the initial cost of the plant if the company raises all equity externally?

Answers: 1

Another question on Business

Business, 22.06.2019 01:40

At the local level, the main role of ctsos is to encourage students to become urge them to programs and competitive events. 1. a.interns b.trainees c.members 2. a.participate b.train c.win

Answers: 2

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

Business, 22.06.2019 07:30

Which two of the following are benefits of consumer programs

Answers: 1

Business, 22.06.2019 08:30

Most angel investors expect a return on investment of question options: 20% to 25% over 5 years. 15% to 20% over 5 years. 75% over 10 years. 100% over 5 years.

Answers: 1

You know the right answer?

Medina corp. has a debt-equity ratio of .75. the company is considering a new plant that will cost $...

Questions

Biology, 19.01.2021 01:50

Arts, 19.01.2021 01:50

Mathematics, 19.01.2021 01:50

Mathematics, 19.01.2021 02:00

English, 19.01.2021 02:00

Social Studies, 19.01.2021 02:00

Arts, 19.01.2021 02:00