Business, 27.11.2019 04:31 christianconklin22

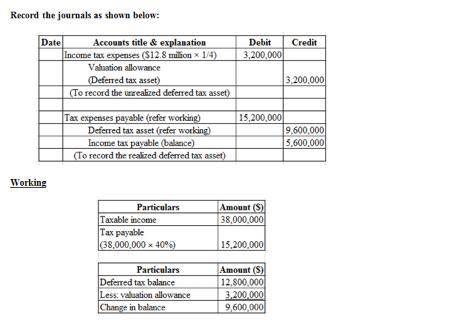

At the end of the year, the deferred tax asset account had a balance of $12.8 million attributable to a cumulative temporary difference of $32 million in a liability for estimated expenses. taxable income is $38.0 million. no temporary differences existed at the beginning of the year, and the tax rate is 40%.prepare the journal entry(s) to record income taxes assuming it is more likely than not that one-fourth of the deferred tax asset will not ultimately be realized. note: these are the correct entries, i am just missing the values (dta is not zero): debit: income tax expense deferred tax asset : income tax payable 15.2debit: income tax expense : valuation allowance - deferred tax asset

Answers: 3

Another question on Business

Business, 22.06.2019 03:10

Transactions that affect earnings do not necessarily affect cash. identify the effect, if any, that each of the following transactions would have upon cash and net income. the first transaction has been completed as an example. (if an amount reduces the account balance then enter with negative sign preceding the number e.g. -15,000 or parentheses e.g. (15, cash net income (a) purchased $120 of supplies for cash. –$120 $0 (b) recorded an adjustment to record use of $35 of the above supplies. (c) made sales of $1,370, all on account. (d) received $700 from customers in payment of their accounts. (e) purchased equipment for cash, $2,450. (f) recorded depreciation of building for period used, $740. click if you would like to show work for this question: open show work

Answers: 3

Business, 22.06.2019 17:30

Gary lives in an area that receives high rainfall and thunderstorms throughout the year. which device would be useful to him to maintain his computer?

Answers: 2

Business, 22.06.2019 19:20

Advertisers are usually very conscious of their audience. choose an issue of a popular magazine such as time, sports illustrated, vanity fair, rolling stone, or the like. from that issue select three advertisements to analyze. try to determine the audience being appealed to in each advertisement and analyze the appeals used to persuade buyers. how might the appeals differ is the ads were designed to persuade a different audience.

Answers: 2

Business, 22.06.2019 22:30

Rahm's credit card issuer calculates interest based on the outstanding balance at the end of the last billing period. what is this method of calculating interest on a credit card called?

Answers: 2

You know the right answer?

At the end of the year, the deferred tax asset account had a balance of $12.8 million attributable t...

Questions

History, 22.06.2021 19:40

Mathematics, 22.06.2021 19:40

Mathematics, 22.06.2021 19:40

Mathematics, 22.06.2021 19:40

Computers and Technology, 22.06.2021 19:40

Mathematics, 22.06.2021 19:40

Mathematics, 22.06.2021 19:40

Mathematics, 22.06.2021 19:40