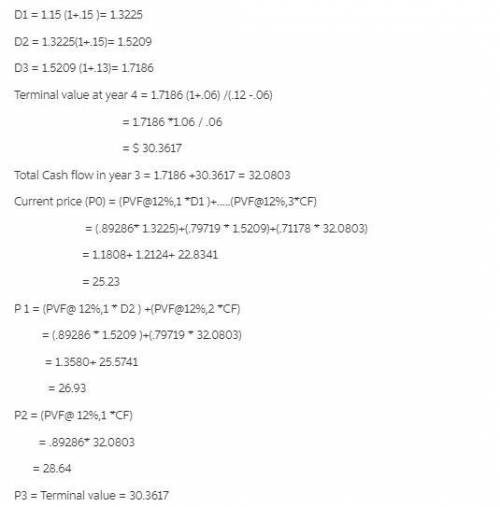

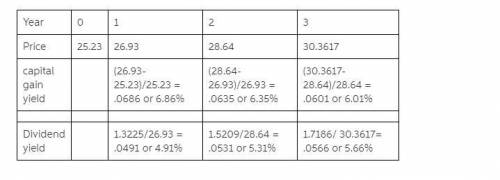

Turbo technology computers is experiencing a period of rapid growth. earnings and dividends are expected to grow at a rate of 15% during the next two years, at 13% in the third year, and at a constant rate of 6% thereafter. turbo’s last dividend was $1.15, and the required rate of return on the stock is 12%.calculate the dividend yield and capital gains yield for years 1, 2, and 3.

Answers: 2

Another question on Business

Business, 21.06.2019 18:30

Theodore is researching computer programming he thinks that this career has a great employment outlook so he’d like to learn if it’s a career in which he would excel what to skills are important for him to have and becoming a successful computer programmer

Answers: 3

Business, 21.06.2019 21:30

You invest all the money you earned during your summer sales job (a total of $45,000) into the stock of a company that produces fat and carb-free cheetos. the company stock is expected to earn a 14% annual return; however, 5 years later it is only worth $20,000. turns out there wasn't as much demand for fat and carb-free cheetos as you had hoped. what is the annual rate of return on your investment?

Answers: 1

Business, 21.06.2019 21:30

The following balance sheet for the los gatos corporation was prepared by a recently hired accountant. in reviewing the statement you notice several errors. los gatos corporation balance sheet at december 31, 2018 assets cash $ 44,000 accounts receivable 86,000 inventories 57,000 machinery (net) 122,000 franchise (net) 32,000 total assets $ 341,000 liabilities and shareholders' equity accounts payable $ 54,000 allowance for uncollectible accounts 7,000 note payable 59,000 bonds payable 112,000 shareholders' equity 109,000 total liabilities and shareholders' equity $ 341,000 additional information: cash includes a $22,000 restricted amount to be used for repayment of the bonds payable in 2022. the cost of the machinery is $194,000. accounts receivable includes a $22,000 note receivable from a customer due in 2021. the note payable includes accrued interest of $7,000. principal and interest are both due on february 1, 2019. the company began operations in 2013. income less dividends since inception of the company totals $37,000. 52,000 shares of no par common stock were issued in 2013. 200,000 shares are authorized. required: prepare a corrected, classified balance sheet. (amounts to be deducted should be indicated by a minus sign.)

Answers: 2

Business, 22.06.2019 20:00

An arithmetic progression involves the addition of the same quantity to each number.which might represent the arithmetic growth of agricultural production

Answers: 3

You know the right answer?

Turbo technology computers is experiencing a period of rapid growth. earnings and dividends are expe...

Questions

Biology, 20.07.2020 21:01

Mathematics, 20.07.2020 21:01

Computers and Technology, 20.07.2020 21:01