Business, 28.11.2019 00:31 lollipop83

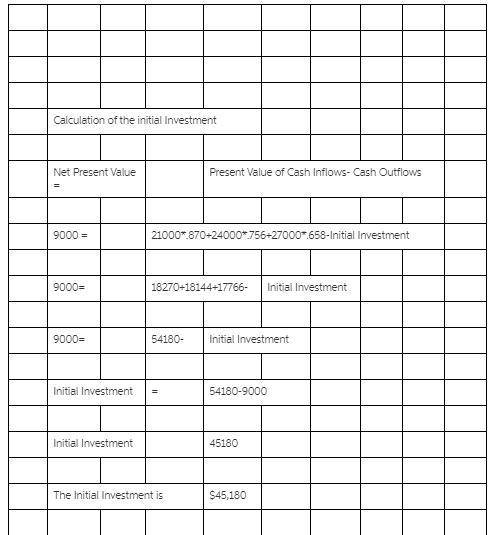

Sloan inc. recently invested in a project with a 3-year life span. the net present value was $9,000 and annual cash inflows were $21,000 for year 1; $24,000 for year 2; and $27,000 for year 3. the initial investment for the project, assuming a 15% required rate of return, was present value pv of an annuity year of 1 at 15% of 1 at 15% 1 .870 .870 2 .756 1.626 3 .658 2.283

Answers: 1

Another question on Business

Business, 22.06.2019 04:00

Assume that the following conditions exist: a. all banks are fully loaned up- there are no excess reserves, and desired excess reserves are always zero. b. the money multiplier is 5 . c. the planned investment schedule is such that at a 4 percent rate of interest, investment =$1450 billion. at 5 percent, investment is $1420 billion. d. the investment multiplier is 3 . e.. the initial equilibrium level of real gdp is $12 trillion. f. the equilibrium rate of interest is 4 percent now the fed engages in contractionary monetary policy. it sells $1 billion worth of bonds, which reduces the money supply, which in turn raises the market rate of interest by 1 percentage point. calculate the decrease in money supply after fed's sale of bonds: $nothing billion.

Answers: 2

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

Business, 23.06.2019 00:10

Warren company plans to depreciate a new building using the double declining-balance depreciation method. the building cost $870,000. the estimated residual value of the building is $57,000 and it has an expected useful life of 20 years. assuming the first year's depreciation expense was recorded properly, what would be the amount of depreciation expense for the second year?

Answers: 2

You know the right answer?

Sloan inc. recently invested in a project with a 3-year life span. the net present value was $9,000...

Questions

Mathematics, 08.11.2020 01:00

Mathematics, 08.11.2020 01:00

Mathematics, 08.11.2020 01:00

History, 08.11.2020 01:00

English, 08.11.2020 01:00

History, 08.11.2020 01:00

History, 08.11.2020 01:00

Mathematics, 08.11.2020 01:00

Arts, 08.11.2020 01:00

Mathematics, 08.11.2020 01:00

Mathematics, 08.11.2020 01:00

Mathematics, 08.11.2020 01:00