Business, 28.11.2019 01:31 sarahbennett11p4yxlb

Flash e - card manufacturing manufactures software parts for the computer software systems that produce e - cards. the flash ii part is currently manufactured in the computer department. the data department also produces the part and the plant has excess capacity to produce the flash ii part. the current market price of the flash ii part is $ 900.. the managerial accountant reported the following manufacturing costs and variable expense data:

flash e - card manufacturing

manufacturing costs and variable expense report

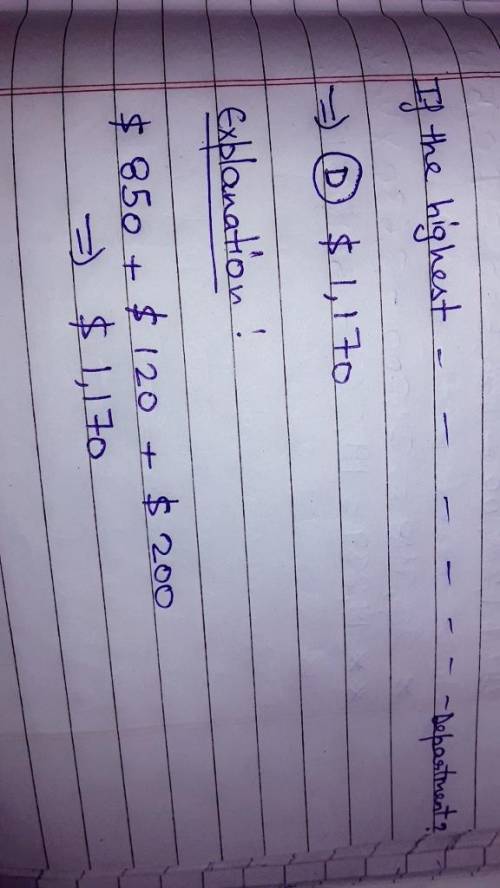

flash component (bold section should be attached to list of expense data below question and the highest acceptable transfer price is $ 900in the market, what is the lowest acceptable in - house price the data department should receive to produce the part in - house at the computerdepartment?

a.$ 850

b.$ 200

c.$ 120

d.$ 1,170

Answers: 1

Another question on Business

Business, 22.06.2019 04:40

Select the correct answerwhat is the responsibility of each of the twelve federal reserve's banks in their districts? a.they set the prime rateob.they monitor functioning of banks in their through onsite and offsite reviewsc.they assess taxes in their destnictd.they write fiscal policies

Answers: 1

Business, 22.06.2019 12:00

In mexico, many garment or sewing shops found they could entice many young people to work for them if they offered clean, air conditioned work areas with high-quality locker rooms to clean up in after the work day. typically, traditional garment shops had to offer to get workers to apply for the hard, repetitive, and somewhat dangerous work. a. benchmark competitive wages b.compensating differentials c. monopoly wages d. wages based on human capital development of each employee

Answers: 3

Business, 22.06.2019 15:00

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 2

Business, 22.06.2019 15:30

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

You know the right answer?

Flash e - card manufacturing manufactures software parts for the computer software systems that prod...

Questions

Biology, 11.07.2019 06:00

Biology, 11.07.2019 06:00

Mathematics, 11.07.2019 06:00

History, 11.07.2019 06:00

Mathematics, 11.07.2019 06:00

Mathematics, 11.07.2019 06:00

Chemistry, 11.07.2019 06:00

Physics, 11.07.2019 06:00

Mathematics, 11.07.2019 06:00