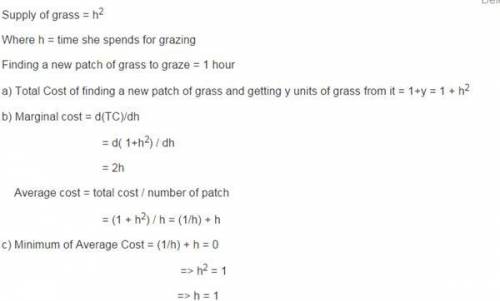

Hildegard, an intelligent and charming holstein cow, grazes in a very large, mostly barren pasture with a few patches of lush grass. when she finds a new grassy area, the amount of grass she gets from it is equal to the square root of the number of hours, h, that she spends grazing there. finding a new patch of grass on which to graze takes her 1 hour. since hildegard does not have pockets, the currency in which her costs are measured is time. (a) what is the total cost to hildegard of finding a new patch of grass and getting y units of grass from it? (b) find an expression for her marginal and her average costs per patch of grass as a function of the amount of grass she gets from each patch. (c) how much time would she spend in each patch if she wanted to maximize her food intake? (hint: minimize the average cost per unit of grass eaten.)

Answers: 3

Another question on Business

Business, 21.06.2019 16:10

Afirm produces a product in a competitive industry and has a total cost function (tc) of tc(q) = 60 + 10q + 2q2 and a marginal cost function (mc) of mc(q) = 10 + 4q. at the given market price (p) of $20, the firm is producing 5.00 units of output. is the firm maximizing profit? no what quantity of output should the firm produce in the long run? the firm should produce unit s) of output. (enter your response as an integer.)

Answers: 3

Business, 22.06.2019 02:20

Archangel manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based on a percentage of direct labor costs. the production details for the year are given below. calculate the manufacturing overhead allocation rate for the year based on the above data. (round your final answer to two decimal places.) a) 42.42% b) 257.14% c) 235.71% d) 1, 206.90% archangel production details.

Answers: 3

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 20:50

Which of the statements best describes why the aggregate demand curve is downward sloping? an increase in the aggregate price level causes consumer and investment spending to fall, because consumer purchasing power decreases and money demand increases. as the aggregate price level increases, consumer expectations about the future change. as the aggregate price level decreases, the stock of existing physical capital increases. as a good's price increases, holding all else constant, the good's quantity demanded decreases.

Answers: 2

You know the right answer?

Hildegard, an intelligent and charming holstein cow, grazes in a very large, mostly barren pasture w...

Questions

Mathematics, 30.01.2020 19:47

Mathematics, 30.01.2020 19:47

Mathematics, 30.01.2020 19:47

Physics, 30.01.2020 19:47

Social Studies, 30.01.2020 19:47

Mathematics, 30.01.2020 19:47

Chemistry, 30.01.2020 19:47

Computers and Technology, 30.01.2020 19:47

Advanced Placement (AP), 30.01.2020 19:47