Business, 29.11.2019 01:31 emilysawyer4363

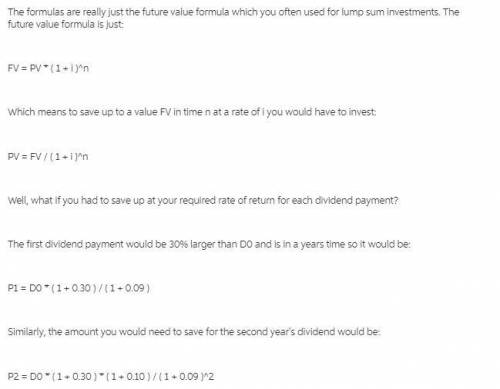

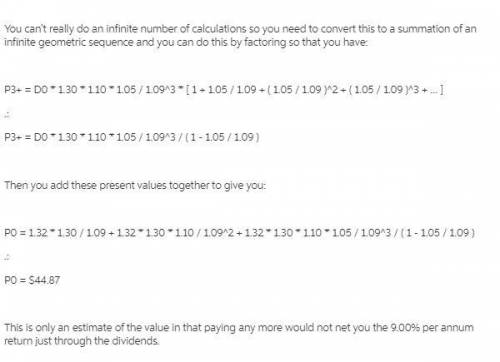

Burke tires just paid a dividend of d0 = $1.32. analysts expect the company's dividend to grow by 30% this year, by 10% in year 2, and at a constant rate of 5% in year 3 and thereafter. the required return on this low-risk stock is 9.00%. what is the best estimate of the stock's current market value? a. $41.59b. $42.65c. $43.75d. $44.87e. $45.99

Answers: 2

Another question on Business

Business, 22.06.2019 09:30

The 39 percent and 38 percent tax rates both represent what is called a tax "bubble." suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $208,000. what would the new 39 percent bubble rate have to be? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places,e.g., 32.16.)

Answers: 3

Business, 22.06.2019 11:00

Factors like the unemployment rate,the stock market,global trade,economic policy,and the economic situation of other countries have no influence on the financial status of individuals. true or false

Answers: 1

Business, 22.06.2019 14:40

Increases in output and increases in the inflation rate have been linked to

Answers: 2

Business, 22.06.2019 15:20

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

You know the right answer?

Burke tires just paid a dividend of d0 = $1.32. analysts expect the company's dividend to grow by 30...

Questions

Spanish, 29.03.2021 19:50

Mathematics, 29.03.2021 19:50

English, 29.03.2021 19:50

Spanish, 29.03.2021 19:50

Mathematics, 29.03.2021 19:50