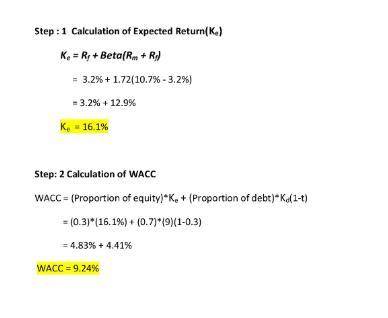

Suppose that finanstagram has a capital structure of 30 percent equity, 70 percent debt, and that its before-tax cost of debt is 9 percent while finanstagram has a beta of 1.72. assume the appropriate tax rate is 30 percent. if the market return is expected to be 10.70 percent and the risk-free rate is 3.20 percent, what will be finanstagram’s wacc?

Answers: 1

Another question on Business

Business, 22.06.2019 14:30

The state in which the manufacturing company you work for is located regulates the presence of a particular substance in the environment to concentrations ≤ x. recently-released, reliable research endorsed by the responsible federal agency conclusively demonstrates that the substance poses no risks at concentrations up to 5x. your company has asked you to consider designing a new process with a waste discharge stream containing up to 2x of the substance. based on the stated conditions, describe this possible.

Answers: 2

Business, 22.06.2019 14:50

Ann chovies, owner of the perfect pasta pizza parlor, uses 20 pounds of pepperoni each day in preparing pizzas. order costs for pepperoni are $10.00 per order, and carrying costs are 4 cents per pound per day. lead time for each order is three days, and the pepperoni itself costs $3.00 per pound. if she were to order 80 pounds of pepperoni at a time, what would be the average inventory level?

Answers: 3

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Business, 23.06.2019 01:50

You are looking at a one-year loan of $16,500. the interest rate is quoted as 8.7 percent plus two points. a point on a loan is 1 percent (one percentage point) of the loan amount. quotes similar to this one are common with home mortgages. the interest rate quotation in this example requires the borrower to pay two points to the lender up front and repay the loan later with 8.7 percent interest. what rate would you actually be paying here?

Answers: 3

You know the right answer?

Suppose that finanstagram has a capital structure of 30 percent equity, 70 percent debt, and that it...

Questions

History, 10.04.2021 15:10

Computers and Technology, 10.04.2021 15:10

Mathematics, 10.04.2021 15:10

Biology, 10.04.2021 15:10

Mathematics, 10.04.2021 15:10

Mathematics, 10.04.2021 15:10

Mathematics, 10.04.2021 15:10

Law, 10.04.2021 15:10