Business, 30.11.2019 02:31 angellong94

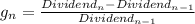

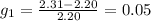

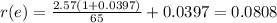

Suppose stark ltd. just issued a dividend of $2.57 per share on its common stock. the company paid dividends of $2.20, $2.31, $2.38, and $2.49 per share in the last four years.

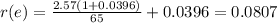

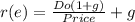

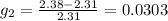

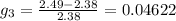

1) if the stock currently sells for $65, what is your best estimate of the company’s cost of equity capital using the arithmetic average growth rate in dividends?

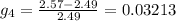

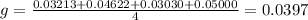

2) what if you use the geometric average growth rate?

Answers: 1

Another question on Business

Business, 21.06.2019 20:50

Last year, western corporation had sales of $5 million, cost of goods sold of $3 million, operating expenses of $175,000 and depreciation of $125,000. the firm received $40,000 in dividend income and paid $200,000 in interest on loans. also, western sold stock during the year, receiving a $40,000 gain on stock owned 6 years, but losing $60,000 on stock owned 4 years. what is the firm's tax liability?

Answers: 2

Business, 22.06.2019 01:30

How will firms solve the problem of an economic surplus a. decrease prices to the market equilibrium price b. decrease prices so they are below the market equilibrium price c.increase prices

Answers: 3

Business, 22.06.2019 09:00

Drag the tiles to the correct boxes to complete the pairs.(there's not just one answer)match each online banking security practice with the pci security requirement that mandates it.1. encrypting transfer of card data2. installing a firewall3. installing antivirus software4. assigning unique ids and user namesa. vulnerability management programb. credit card data protectionc. strong access controlsd. secure network

Answers: 3

You know the right answer?

Suppose stark ltd. just issued a dividend of $2.57 per share on its common stock. the company paid d...

Questions

![g=\sqrt[n]{(1+g_{1} )(1+g_{2} )(1+g_{3} )...(1+g_{n} )}](/tpl/images/0396/6527/89488.png)

![g=\sqrt[4]{(1+0.03213 )(1+0.04622 )(1+0.0303 )(1+0.0500 )} =0.0396](/tpl/images/0396/6527/a40e9.png)