Business, 02.12.2019 00:31 sindy35111

Mike karanikolas wants to enter the french market with his usual strategy of using influencers. two influencers are considered to be hired.

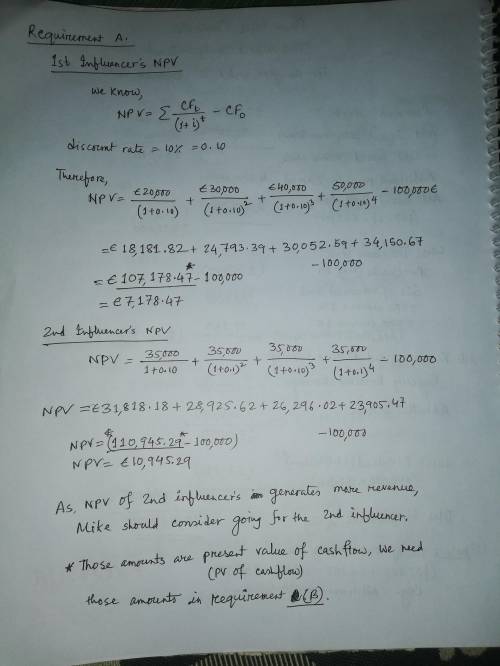

the first one is a young growing personality and asks for a consideration of 100 000€ to be paid at the start of the contract, and mike determines that over 4 years, this particular influencer would yield successively each year: 20 000€, 30 000€, 40 000€, 50 000€. those amounts would be actualised at a 10% rate to take risk into account.

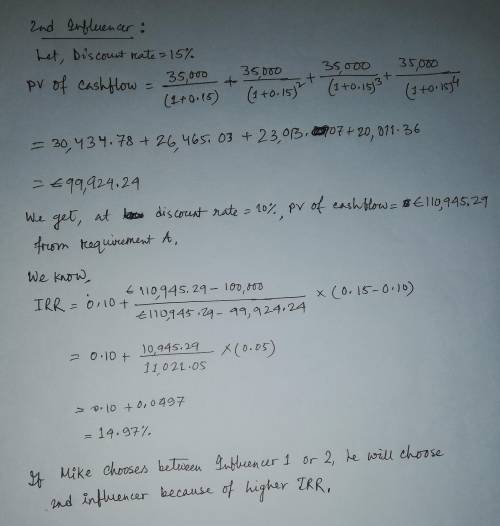

is it a good investment? answer to this question based on two selection criteria: net present value and internal rate of return.

the second influencer is more stable and is asking for the same 100 000€ consideration, but revenues would be more stable at 35 000€ every year at the end of the next 4 years.

is the second influencer a better choice than the first influencer? answer to this question based on the npv criterion.

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

Asavings account that pays interest every 3 months is said to have a interest period

Answers: 1

Business, 22.06.2019 08:30

Match the items with the actions necessary to reconcile the bank statement.(there's not just one answer)1. interest credited in bank account2. fee charged by bank for returned check3. checks issued but not deposited4. deposits yet to be crediteda. add to bank statementb. deduct from bank statementc. add to personal statementd. deduct from personal statement

Answers: 2

Business, 22.06.2019 10:20

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

You know the right answer?

Mike karanikolas wants to enter the french market with his usual strategy of using influencers. two...

Questions

Chemistry, 15.12.2019 19:31

Mathematics, 15.12.2019 19:31

English, 15.12.2019 19:31

Mathematics, 15.12.2019 19:31

Physics, 15.12.2019 19:31

Mathematics, 15.12.2019 19:31