Business, 03.12.2019 01:31 allisonzawodny3533

On january 1, 2017, bensen company leased equipment to flynn corporation. the following information pertains to this lease.

the term of the non-cancelable lease is 6 years. at the end of the lease term, flynn has the option to purchase the equipment for $1,000, while the expected residual value at the end of the lease is $5,000.

equal rental payments are due on january 1 of each year, beginning in 2017.

the fair value of the equipment on january 1, 2017, is $150,000, and its cost is $120,000.

the equipment has an economic life of 8 years. flynn depreciates all of its equipment on a straight-line basis.

bensen set the annual rental to ensure a 5% rate of return. flynn's incremental borrowing rate is 6%, and the implicit rate of the lessor is unknown.

collectibility of lease payments by the lessor is probable. (both the lessor and the lessee's accounting periods end on december 31.)

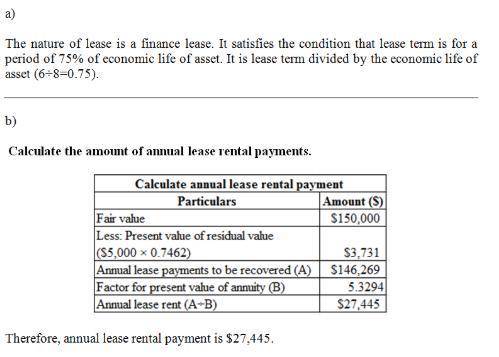

(a) discuss the nature of this lease to bensen and flynn.

(b) calculate the amount of the annual rental payment.

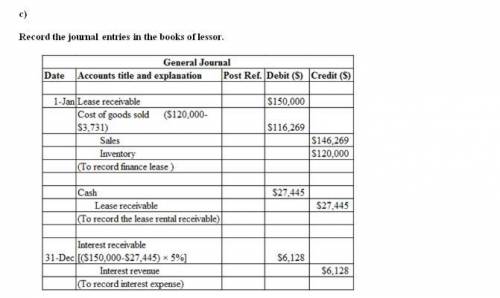

(c) prepare all the necessary journal entries for bensen for 2017.

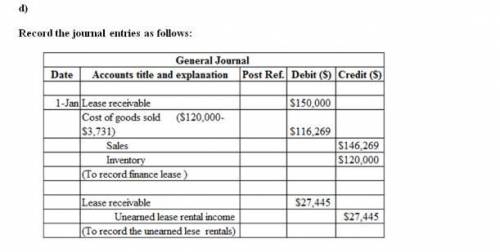

(d) suppose the collectibility of the lease payments was not probable for bensen. prepare all necessary journal entries for the company in 2017.

(e) prepare all the necessary journal entries for flynn for 2017.

(f) discuss the effect on the journal entry for flynn at lease commencement, assuming initial direct costs of $2,000 are incurred by flynn to negotiate the lease.

Answers: 3

Another question on Business

Business, 21.06.2019 15:00

Wanda has graduated from community university (cu) and after nine months has failed to find a job. she graduated with a degree in business, and her college was aacsb accredited. (aacsb accreditation is a specialized accreditation for business schools that evidences a quality program.) in her complaint, she alleges that four years of school and tuition should guarantee a job in the field of study and states that she wants her money back. at no time did cu guarantee job placement, either through express or implied statements. wanda does not disagree with this but still thinks that she was wronged and that it is unfair to graduate and not get a job automatically. cu will be successful in extinguishing wanda's lawsuit if its attorney files a

Answers: 2

Business, 21.06.2019 22:00

The market yield on spice grills' bonds is 15%, and the firm's marginal tax rate is 33%. what is their shareholders' required return if the equity risk premium is 4%?

Answers: 1

Business, 22.06.2019 12:30

M. cotteleer electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. one of the components has an annual demand of 235 units, and this is constant throughout the year. carrying cost is estimated to be $1.25 per unit per year, and the ordering (setup) cost is $21 per order. a) to minimize cost, how many units should be ordered each time an order is placed? b) how many orders per year are needed with the optimal policy? c) what is the average inventory if costs are minimized? d) suppose that the ordering cost is not $21, and cotteleer has been ordering 125 units each time an order is placed. for this order policy (of q = 125) to be optimal, determine what the ordering cost would have to be.

Answers: 1

Business, 23.06.2019 12:00

Lipman auto parts, a family-owned auto parts store, began january with $10,300.00 in cash. management forecasts that collections from credit customers will be $11,400.00 in january and $14,800.00 in february. the store is scheduled to receive $5,000.00 in cash on a business note receivable in january. projected cash payments include inventory purchases ($13,000.00 in january and $13,600.00 in february) and operating expenses ($2,700.00 each month). lipman auto parts' bank requires a $10,000.00 minimum balance in the store's checking account. at the end of any month when the account balance dips below $10,000.00, the bank automatically extends credit to the store in multiples of $1,000.00. lipman auto parts borrows as little as possible and pays back loans in quarterly installments of $2,000.00, plus 4 percent interest on the entire unpaid principal. the first payment occurs three months after the loan.

Answers: 2

You know the right answer?

On january 1, 2017, bensen company leased equipment to flynn corporation. the following information...

Questions

Mathematics, 09.09.2020 22:01

Physics, 09.09.2020 22:01

Biology, 09.09.2020 22:01

Mathematics, 09.09.2020 22:01

Mathematics, 09.09.2020 22:01

English, 09.09.2020 22:01