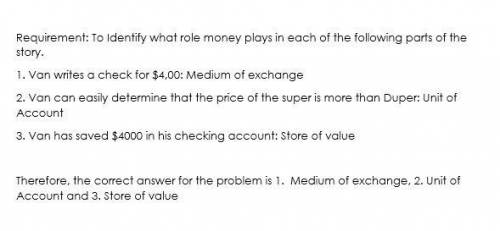

Alex just graduated from college and is now in the market for a new car. he has saved up $4,000 for a down payment. he's deciding between a super and a duper. the super is priced at $23,599, and the duper is priced at $18,999. after agonizing over the decision, he decides to buy the duper. he writes the dealership a check for $4,000 and takes out a loan for the remainder of the purchase price. identify what role money plays in each of the following parts of the story. hint: select each role only once. role of money medium of exchange unit of account store of value alex writes a check for $4,000. alex can easily determine that the price of the super is more than the price of the duper. alex has saved $4,000 in his checking account.

Answers: 3

Another question on Business

Business, 22.06.2019 00:50

Hanna intends to give her granddaughter, melodee, her antique hat pin. this heirloom has been kept under lock and key in the wall vault in the library of hanna's house in virginia. the hat pin is currently the only item in the vault. when hanna is visiting melodee in connecticut, hanna gives melodee the only key to the vault. melodee is grateful for the present and excitedly accepts. in this situation has there been a completed gift?

Answers: 3

Business, 22.06.2019 20:40

Which of the following is true concerning the 5/5 lapse rule? a) the 5/5 lapse rule deems that a taxable gift has been made where a power to withdraw in excess of $5,000 or five percent of the trust assets is lapsed by the powerholder. b) the 5/5 lapse rule only comes into play with a single beneficiary trust. c) amounts that lapse under the 5/5 lapse rule qualify for the annual exclusion. d) gifts over the 5/5 lapse rule do not have to be disclosed on a gift tax return.

Answers: 1

Business, 23.06.2019 10:00

Brody and tanya recently sold some land they owned for $150,000. they received the land five years ago as a wedding gift from brody's aunt jeanette. she had already given them cash equal to the annual exclusion during that year. aunt jeanette purchased the land many years ago when the property was worth $20,000. at the time of the gift, the property was worth $100,000 and aunt jeanette paid $47,000 in gift tax. what is the long term capital gain on the sale of the property

Answers: 3

Business, 23.06.2019 18:10

Which one of the following best describes pro forma financial statements? select one: a. financial statements expressed in a foreign currency b. financial statements where the assets are expressed as a percentage of total assets and costs are expressed as a percentage of sales c. financial statements showing projected values for future time periods d. financial statements expressed in real dollars, given a stated base year e. financial statements where all accounts are expressed as a percentage of last year's values

Answers: 3

You know the right answer?

Alex just graduated from college and is now in the market for a new car. he has saved up $4,000 for...

Questions

Mathematics, 20.11.2020 17:30

Mathematics, 20.11.2020 17:30

History, 20.11.2020 17:30

English, 20.11.2020 17:30

History, 20.11.2020 17:30