Business, 04.12.2019 02:31 zhellyyyyy

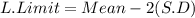

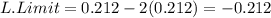

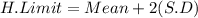

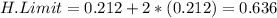

The average annual return over the period 1926-2009 for small stocks is 21.2%, and the standard

deviation of returns is 21.2%. based on these numbers, what is a 95% confidence interval for

2010 returns?

a) -10.6%, 31.8%

b) 0%, 42.4%

c) -21.2%, 42.4%

d) -21.2%, 63.6%

Answers: 3

Another question on Business

Business, 22.06.2019 10:50

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 3

Business, 22.06.2019 15:10

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

Business, 22.06.2019 18:10

Find the zeros of the polynomial 5 x square + 12 x + 7 by factorization method and verify the relation between zeros and coefficient of the polynomials

Answers: 1

You know the right answer?

The average annual return over the period 1926-2009 for small stocks is 21.2%, and the standard

Questions

Mathematics, 27.03.2020 22:13

Mathematics, 27.03.2020 22:13

Mathematics, 27.03.2020 22:13

Mathematics, 27.03.2020 22:13

History, 27.03.2020 22:13

Arts, 27.03.2020 22:13

English, 27.03.2020 22:13

Mathematics, 27.03.2020 22:13

Mathematics, 27.03.2020 22:13

Chemistry, 27.03.2020 22:13