Business, 06.12.2019 20:31 hnsanders00

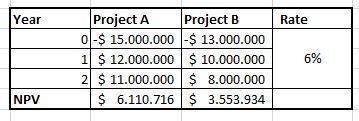

Consider two projects: project a currently costs $15 million, which is to be paid this year. the returns are $12 million after in one year and $11 million in two years. project b currently costs $13 million, again to be paid this year. the returns are $10 million after in one year and $8 million in two years.

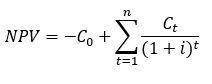

at an interest rate of 6%, the net present value of project a is roughly , while the net present value of project b is roughly .

suppose investing in one project eliminates the opportunity to invest in the other. if the interest rate is 6%, project is preferable.

Answers: 3

Another question on Business

Business, 22.06.2019 01:30

How will firms solve the problem of an economic surplus a. decrease prices to the market equilibrium price b. decrease prices so they are below the market equilibrium price c.increase prices

Answers: 3

Business, 22.06.2019 06:00

Use this image to answer the following question. when the economy is operating at point b, the us congress is most likely to follow

Answers: 3

Business, 22.06.2019 12:20

Over the past decade, brands that were once available only to the wealthy have created more affordable product extensions, giving a far broader range of consumers a taste of the good life. jaguar, for instance, launched its x-type sedan, which starts at $30,000 and is meant for the "almost rich" consumer who aspires to live in luxury. by marketing to people who desire a luxurious lifestyle, jaguar is using:

Answers: 3

Business, 22.06.2019 21:00

Identify whether the statements are true or false by dragging and dropping the appropriate term into the bin provided. long-run economic growth is unlikely to be sustainable because of finite natural resources. in the modern economy, countries that possess few domestic natural resources essentially have no chance to develop economically. finding alternatives to natural resources will be very important to long-term economic growth. in the modern economy, human and physical capital are generally less important in productivity than natural resources. in the 19th century, countries with the highest per capita gdp were nearly always abundant in minerals and productive farming land.

Answers: 1

You know the right answer?

Consider two projects: project a currently costs $15 million, which is to be paid this year. the re...

Questions

Mathematics, 25.01.2021 21:00

Mathematics, 25.01.2021 21:00

Chemistry, 25.01.2021 21:00

Computers and Technology, 25.01.2021 21:00

Business, 25.01.2021 21:00

Mathematics, 25.01.2021 21:00

Health, 25.01.2021 21:00

Health, 25.01.2021 21:00

Mathematics, 25.01.2021 21:00

Mathematics, 25.01.2021 21:00