Business, 07.12.2019 00:31 nehakarakkattu

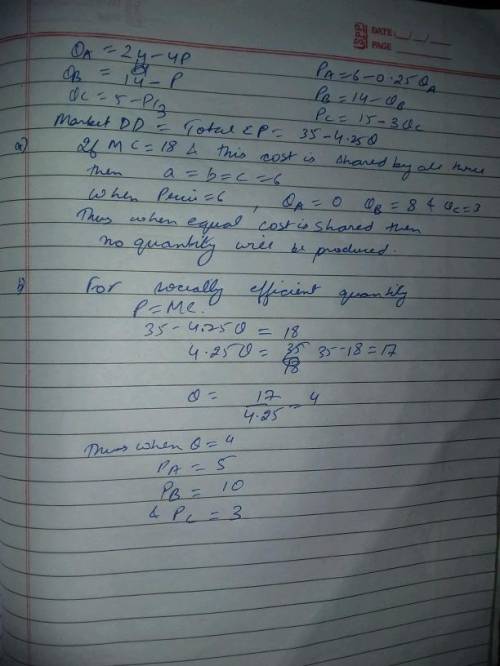

Amy, brooke, and chelsea live in minneapolis. amy's demand for bike paths, a public good, is given by q=24-4p. brooke's demand is q-14-p. and chelsea's is q-5-p/3. the marginal cost of building a bike path is mc-18. the town government decides to use the following procedure for deciding how many paths to build. it als each resident how many paths she wants, and it builds the largest number asked for by any resident. to pay for these paths, it then taxes amy, brooke, and chelsea the prices a, b, and c per path, respectively, where a++mo. the residents know these tax rates before stating how many paths they want.) if the taxes are set so that each resident shares the cost evenly ( a c ), how many paths will get built? show that the government can achieve the social optimum by setting the correct tax prices a, b, and c. what prices should it set?

Answers: 1

Another question on Business

Business, 22.06.2019 16:20

Stosch company's balance sheet reported assets of $112,000, liabilities of $29,000 and common stock of $26,000 as of december 31, year 1. if retained earnings on the balance sheet as of december 31, year 2, amount to $74,000 and stosch paid a $28,000 dividend during year 2, then the amount of net income for year 2 was which of the following? a)$23,000 b) $35,000 c) $12,000 d)$42,000

Answers: 1

Business, 22.06.2019 19:30

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

Business, 23.06.2019 01:00

What are the benefits of different types of career education, like community colleges, vocational training programs, and four-year colleges?

Answers: 3

Business, 23.06.2019 02:10

Make or buy eastside company incurs a total cost of $120,000 in producing 10,000 units of a component needed in the assembly of its major product. the component can be purchased from an outside supplier for $11 per unit. a related cost study indicates that the total cost of the component includes fixed costs equal to 50% of the variable costs involved. a. should eastside buy the component if it cannot otherwise use the released capacity? present your answer in the form of differential analysis. use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers. cost from outside supplier $answer variable costs avoided by purchasing answer net advantage (disadvantage) to purchase alternative $answer b. what would be your answer to requirement (a) if the released capacity could be used in a project that would generate $50,000 of contribution margin? use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers.

Answers: 2

You know the right answer?

Amy, brooke, and chelsea live in minneapolis. amy's demand for bike paths, a public good, is given b...

Questions

Mathematics, 09.04.2022 05:50

Geography, 09.04.2022 05:50

Mathematics, 09.04.2022 05:50

History, 09.04.2022 05:50

English, 09.04.2022 06:40

Mathematics, 09.04.2022 06:40

Physics, 09.04.2022 06:40

Chemistry, 09.04.2022 06:40

Mathematics, 09.04.2022 06:40

English, 09.04.2022 06:50

Mathematics, 09.04.2022 07:00