Business, 07.12.2019 02:31 wilkinsonei4069

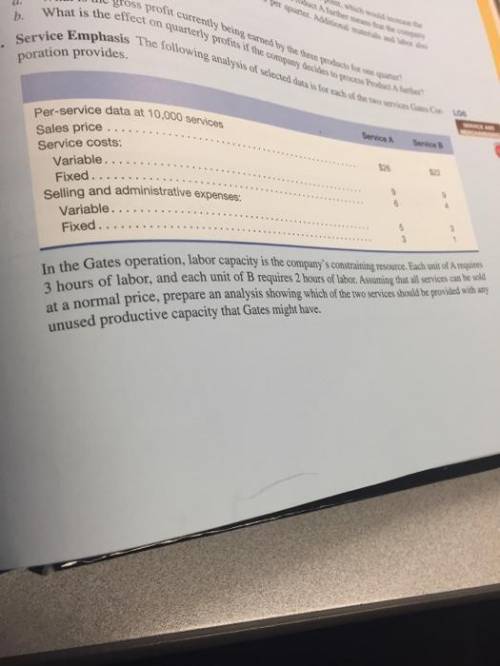

In the gates operation, labor capacity is the company's constraining resource. each unit of a requires 3 hours of labor, and each unit of b requires 2 hours of labor. assuming that all services can be sold at a normal price, prepare an analysis showing which of the two services should be provided with any unused productive capacity that gates might have. service a b revenue answer 0 answer 0 less: variable cost answer 0 answer 0 contribution margin answer 0 answer 0 labor hours per unit answer 0 answer 0 contribution margin per labor hour answer 0 answer 0 any unused capacity should be devoted to service b, which has $1 less contribution margin per labor hour than does service a. any unused capacity should be devoted to service a, which has $1 more contribution margin per labor hour than does service a. any unused capacity should be devoted to service b, which has $1 more contribution margin per labor hour than does service a. answer all parts of the question. either of those and id be golden

Answers: 3

Another question on Business

Business, 22.06.2019 11:10

How much are you willing to pay for a zero that matures in 10 years, has a face value of $1,000 and your required rate of return is 7%? round to the nearest cent. do not include a dollar sign in your answer. (i.e. if your answer is $432.51, then type 432.51 without $ sign)

Answers: 1

Business, 22.06.2019 22:00

On january 8, the end of the first weekly pay period of the year, regis company's payroll register showed that its employees earned $22,760 of office salaries and $70,840 of sales salaries. withholdings from the employees' salaries include fica social security taxes at the rate of 6.20%, fica medicare taxes at the rate of 1.45%, $13,260 of federal income taxes, $1,450 of medical insurance deductions, and $860 of union dues. no employee earned more than $7,000 in this first pay period. required: 1.1 calculate below the amounts for each of these four taxes of regis company. regis’s merit rating reduces its state unemployment tax rate to 3% of the first $7,000 paid to each employee. the federal unemployment tax rate is 0.60

Answers: 3

Business, 22.06.2019 23:30

Which statement best describes entrepreneurship aitmakes people very rich b it relies on large financial investments c it is only possible in the retail industry d it requires creativity and ambition

Answers: 3

Business, 23.06.2019 00:30

Listed below are several transactions that took place during the first two years of operations for the law firm of pete, pete, and roy.year 1 year 2amounts billed to clients for services rendered $ 170,000 $ 220,000 cash collected from clients 160,000 190,000 cash disbursements salaries paid to employees for services rendered during the year 90,000 100,000 utilities 30,000 40,000 purchase of insurance policy 60,000 0 in addition, you learn that the company incurred utility costs of $35,000 in year 1, that there were no liabilities at the end of year 2, no anticipated bad debts on receivables, and that the insurance policy covers a three-year period.required: 1. & 3. calculate the net operating cash flow for years 1 and 2 and determine the amount of receivables from clients that the company would show in its year 1 and year 2 balance sheets prepared according to the accrual accounting model.2. prepare an income statement for each year according to the accrual accounting model.

Answers: 1

You know the right answer?

In the gates operation, labor capacity is the company's constraining resource. each unit of a requir...

Questions

English, 04.11.2019 17:31

Arts, 04.11.2019 17:31

Advanced Placement (AP), 04.11.2019 17:31

Mathematics, 04.11.2019 17:31

History, 04.11.2019 17:31

Mathematics, 04.11.2019 17:31

Social Studies, 04.11.2019 17:31

Mathematics, 04.11.2019 17:31

Chemistry, 04.11.2019 17:31

Mathematics, 04.11.2019 17:31

Mathematics, 04.11.2019 17:31