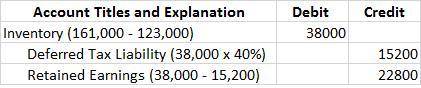

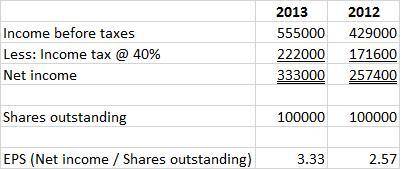

The cecil-booker vending company changed its method of valuing inventory from the average cost method to the fifo cost method at the beginning of 2013. at december 31, 2012, inventories were $123,000 (average cost basis) and were $127,000 a year earlier. cecil-booker’s accountants determined that the inventories would have totaled $161,000 at december 31, 2012, and $166,000 at december 31, 2011, if determined on a fifo basis. a tax rate of 40% is in effect for all years. one hundred thousand common shares were outstanding each year. income from continuing operations was $430,000 in 2012 and $555,000 in 2013. there were no extraordinary items either year. required: 1.prepare the journal entry to record the change in accounting principle. (if no entry is required for a particular event, select "no journal entry required" in the first account field.)2. prepare the 2013–2012 comparative income statements beginning with income from continuing operations. include per share amounts. (round eps answers to 2 decimal places.) comparative income statements 2013 2013 earnings per common share

Answers: 1

Another question on Business

Business, 22.06.2019 01:10

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning econ

Answers: 3

Business, 22.06.2019 10:20

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 14:50

Prepare beneish corporation's income statement and statement of stockholders' equity for year-end december 31, and its balance sheet as of december 31. there were no stock issuances or repurchases during the year. (do not use negative signs with your answers unless otherwise noted.)

Answers: 2

Business, 22.06.2019 15:40

Colter steel has $5,550,000 in assets. temporary current assets $ 3,100,000 permanent current assets 1,605,000 fixed assets 845,000 total assets $ 5,550,000 assume the term structure of interest rates becomes inverted, with short-term rates going to 10 percent and long-term rates 2 percentage points lower than short-term rates. earnings before interest and taxes are $1,170,000. the tax rate is 40 percent earnings after taxes = ?

Answers: 1

You know the right answer?

The cecil-booker vending company changed its method of valuing inventory from the average cost metho...

Questions

Biology, 18.09.2019 11:30

History, 18.09.2019 11:30

Mathematics, 18.09.2019 11:30

Mathematics, 18.09.2019 11:30

Mathematics, 18.09.2019 11:30

Mathematics, 18.09.2019 11:30

Social Studies, 18.09.2019 11:30

Chemistry, 18.09.2019 11:30

Mathematics, 18.09.2019 11:30