Business, 09.12.2019 20:31 kalialee2424

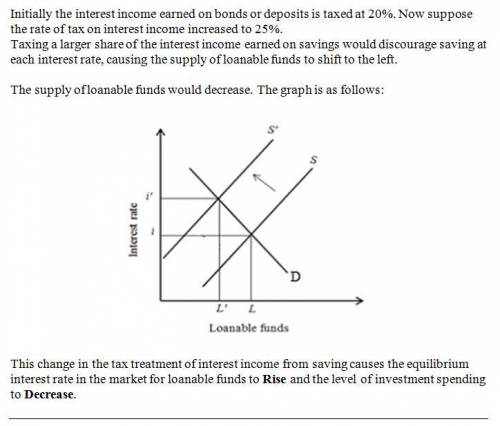

Suppose savers either buy bonds or make deposits in savings accounts at banks. initially, the interest income earned on bonds or deposits is taxed at a rate of 20%. now suppose there is an increase in the tax rate on interest income, from 20% to 25%. shift the appropriate curve on the graph to reflect this change.

this change in the tax treatment of interest income from saving causes the equilibrium interest rate in the market for loanable funds to fall/rise and the level of investment spending to decrease/increase.

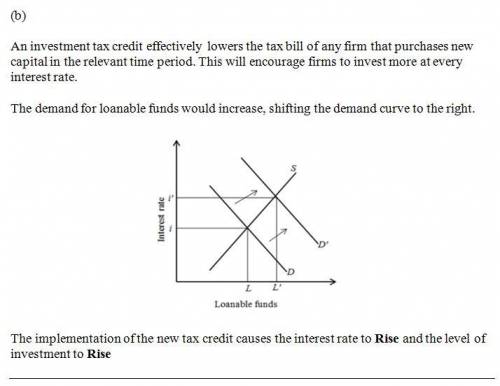

an investment tax credit effectively lowers the tax bill of any firm that purchases new capital in the relevant time period. suppose the government implements a new investment tax credit.

shift the appropriate curve on the graph to reflect this change.

the implementation of the new tax credit causes the interest rate to fall/rise and the level of investment to fall/rise .

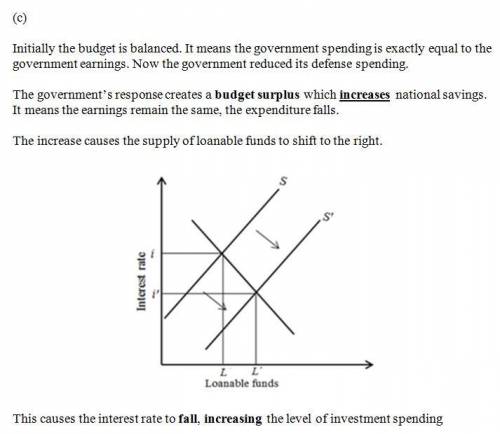

initially, the government's budget is balanced, then the government responds to the conclusion of a war by significantly reducing defense spending without changing taxes.

this change in spending causes the government to run a budget deficit/surplus, which increases/decreases national saving.

shift the appropriate curve on the graph to reflect this change.

this causes the interest rate to fall/rise , crowding out/increasing the level of investment spending.

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

What is the relationship between the national response framework and the national incident management system (nims)? a. the national response framework replaces the nims, which is now obsolete. b. the response protocols and structures described in the national response framework align with the nims, and all nims components support response. c. the nims relates to local, state, and territorial operations, whereas the nrf relates strictly to federal operations. d. the nims and the national response framework cover different aspects of incident management—the nims is focused on tactical planning, and the national response framework is focused on coordination.

Answers: 3

Business, 22.06.2019 07:30

An important application of regression analysis in accounting is in the estimation of cost. by collecting data on volume and cost and using the least squares method to develop an estimated regression equation relating volume and cost, an accountant can estimate the cost associated with a particular manufacturing volume. consider the following sample of production volumes and total cost data for a manufacturing operation. production volume (units) total cost ($) 400 4000 450 5000 550 5400 600 5900 700 6400 750 7000 compute b 1 and b 0 (to 2 decimals if necessary). b 1 b 0 complete the estimated regression equation (to 2 decimals if necessary). = + x what is the variable cost per unit produced (to 1 decimal)? $ compute the coefficient of determination (to 4 decimals). note: report r 2 between 0 and 1. r 2 = what percentage of the variation in total cost can be explained by the production volume (to 2 decimals)? % the company's production schedule shows 500 units must be produced next month. what is the estimated total cost for this operation (to 2 decimals)? $

Answers: 1

Business, 22.06.2019 07:50

The questions of economics address which of the following ? check all that apply

Answers: 3

Business, 22.06.2019 08:40

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity.calculate the cost of new stock using the dividend growth approach.what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics.each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings.equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

You know the right answer?

Suppose savers either buy bonds or make deposits in savings accounts at banks. initially, the intere...

Questions

Mathematics, 08.10.2019 02:00

World Languages, 08.10.2019 02:00

Mathematics, 08.10.2019 02:00

Mathematics, 08.10.2019 02:00

Mathematics, 08.10.2019 02:00

Social Studies, 08.10.2019 02:00

Geography, 08.10.2019 02:00