Business, 09.12.2019 21:31 sbender2901

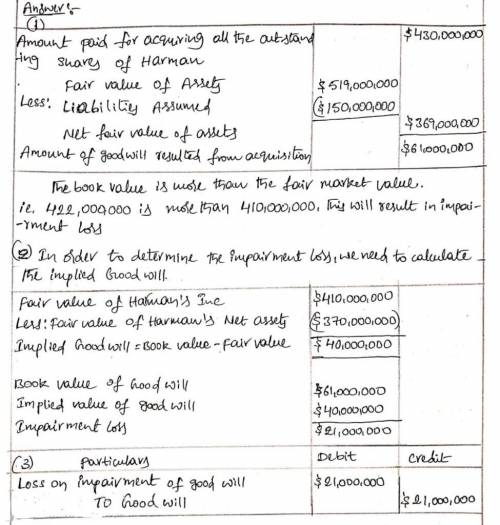

On may 28, 2021, pesky corporation acquired all of the outstanding common stock of harman, inc., for $430 million. the fair value of harman's identifiable tangible and intangible assets totaled $519 million, and the fair value of liabilities assumed by pesky was $150 million. pesky performed a goodwill impairment test at the end of its fiscal year ended december 31, 2021. management has provided the following information: fair value of harman, inc.$410millionfair value of harman's net assets (excluding goodwill) 370millionbook value of harman's net assets (including goodwill) 422million required: 1. determine the amount of goodwill that resulted from the harman acquisition.2. determine the amount of goodwill impairment loss that pesky should recognize at the end of 2021, if any.3. if an impairment loss is required, prepare the journal entry to record the loss.

Answers: 2

Another question on Business

Business, 22.06.2019 02:20

Larissa has also provided the following information. during the year, the company raised $36 million in new long-term debt and retired $20.52 million in long-term debt. the company also sold $22 million in new stock and repurchased $32.4 million. the company purchased $54 million in fixed assets, and sold $6,107,400 in fixed assets. larissa has asked dan to prepare the financial statement of cash flows and the accounting statement of cash flows. she has also asked you to answer the following questions: 1. how would you describe east coast yachts' cash flows? 2. which cash flows statement more accurately describes the cash flows at the company? 3. in light of your previous answers, comment on larissa's expansion plans.

Answers: 2

Business, 22.06.2019 06:00

Why might a business based on a fad be a good idea? question 2 options: fads bring in the most customers. some fads are longer lasting than expected. fads have made some business owners incredibly wealthy. fads can take a business in a new direction.

Answers: 2

Business, 22.06.2019 10:50

Bill dukes has $100,000 invested in a 2-stock portfolio. $62,500 is invested in stock x and the remainder is invested in stock y. x's beta is 1.50 and y's beta is 0.70. what is the portfolio's beta? do not round your intermediate calculations. round the final answer to 2 decimal places.

Answers: 2

Business, 22.06.2019 20:00

With the slowdown of business, how can starbucks ensure that the importance of leadership development does not get overlooked?

Answers: 3

You know the right answer?

On may 28, 2021, pesky corporation acquired all of the outstanding common stock of harman, inc., for...

Questions

Mathematics, 15.12.2020 21:30

Physics, 15.12.2020 21:30

Mathematics, 15.12.2020 21:30

History, 15.12.2020 21:30

Social Studies, 15.12.2020 21:30

Geography, 15.12.2020 21:30

Biology, 15.12.2020 21:30

Mathematics, 15.12.2020 21:30