Business, 09.12.2019 21:31 yogibear5806

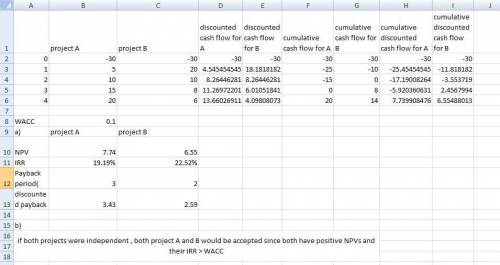

Your division is considering two projects. its wacc is 10% and the projects' after-tax cash flow(in millions of dollars) would be as follows: 0 1 2 3 4project a - $30 $5 $10 $15 $20project b - $30 $20 $10 $8 $6(a) calculate the projects' npvs, irrs, regular paybacks, and discounted paybacks.(b) if the two projects are independent, which project(s) should be chosen ?

Answers: 2

Another question on Business

Business, 22.06.2019 06:00

Why might a business based on a fad be a good idea? question 2 options: fads bring in the most customers. some fads are longer lasting than expected. fads have made some business owners incredibly wealthy. fads can take a business in a new direction.

Answers: 2

Business, 22.06.2019 08:00

Why is it vital to maintain a designer worksheet? a. it separates the designs chosen for the season from those rejected by the company. b. it keeps a record of all designs created by the designer for a season. c. it charts out the development of an entire line through the season and beyond. d. it tracks the development of a design along with costing and production details. done

Answers: 1

Business, 22.06.2019 13:40

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

Business, 22.06.2019 21:00

In a transportation minimization problem, the negative improvement index associated with a cell indicates that reallocating units to that cell would lower costs.truefalse

Answers: 1

You know the right answer?

Your division is considering two projects. its wacc is 10% and the projects' after-tax cash flow(in...

Questions

Biology, 23.01.2020 21:31

Geography, 23.01.2020 21:31

English, 23.01.2020 21:31

Spanish, 23.01.2020 21:31

History, 23.01.2020 21:31

Mathematics, 23.01.2020 21:31

Mathematics, 23.01.2020 21:31