Business, 10.12.2019 01:31 advancedgamin8458

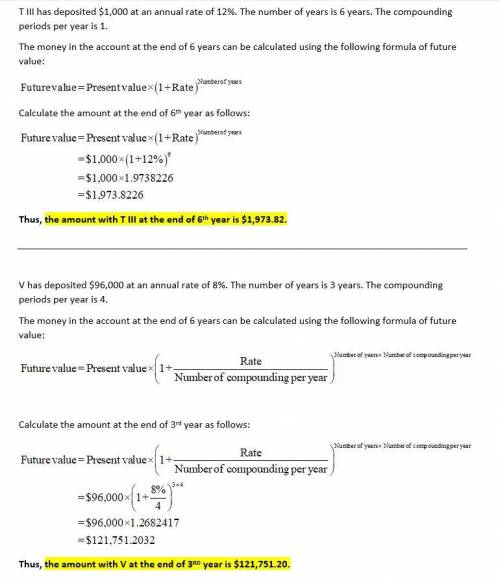

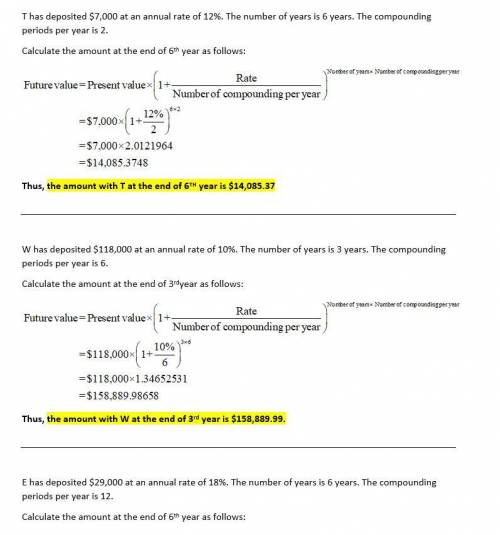

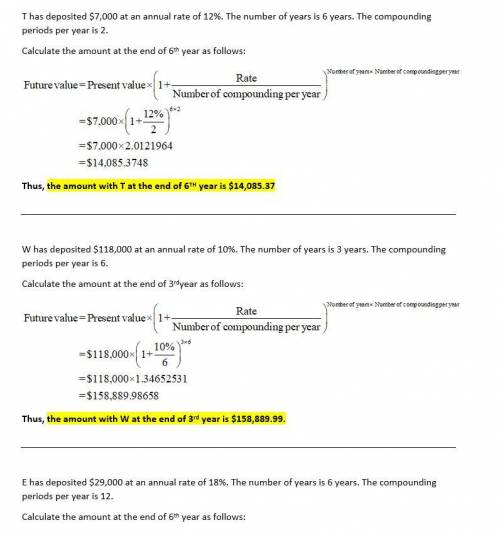

Compound interest with non-annual periods: calculate the amount of money that will be in each of the following accounts at the end of the given deposit periods: account holder, amount deposited, annual interest rate, compounding periods per year, compouding periodstheodore logan iii, 1000, 12%, 1, 6vernell coles, 96000, 8%, 4, 3tina elliot, 7000, 12%, 2, 6wayne robinson, 118000, 10%, 6, 3eunice chung, 29000, 18%, 12, 6kelly cravens, 15000, 8%, 3, 3the amount of money for theodore at end of 6 years is (i got $1973.82)? the amount of money for vernell at end of 3 years will be (i got $121751.21)the amount of money for tina at end of 6 years will be amount of money for wayne at end of 3 years will be amount of money for eunice at end of 6 years will be

Answers: 3

Another question on Business

Business, 21.06.2019 22:30

Abusiness cycle reflects in economic activity, particularly real gdp. the stages of a business cycle

Answers: 2

Business, 22.06.2019 03:20

Yael decides that she no longer enjoys her job, and she quits to open a gluten-free, dairy-free kosher bakery. she pays a monthly rent for her store of $2,000. her labor costs for one month are $4,500, and she spends $6,000 a month on nut flours, sugar, and other supplies. yael was earning $2,500 a month working as a bank teller. these are her only costs. her monthly revenue is $14,000. which of the following statements about yael’s costs and profit are correct? correct answer(s) an accountant would say she is earning a monthly profit of $1,500. her implicit costs are $2,500 a month. an economist would tell her that she is experiencing a loss. her total costs are $12,500 a month. her explicit costs include the labor, rent, and supplies for her store. her economic profit is $1,500 a month.

Answers: 3

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 16:40

Job 456 was recently completed. the following data have been recorded on its job cost sheet: direct materials $ 2,418 direct labor-hours 74 labor-hours direct labor wage rate $ 13 per labor-hour machine-hours 137 machine-hours the corporation applies manufacturing overhead on the basis of machine-hours. the predetermined overhead rate is $14 per machine-hour. the total cost that would be recorded on the job cost sheet for job 456 would be: multiple choice $3,380 $5,298 $6,138 $2,622

Answers: 1

You know the right answer?

Compound interest with non-annual periods: calculate the amount of money that will be in each of th...

Questions

Mathematics, 10.12.2020 20:30

Mathematics, 10.12.2020 20:30

English, 10.12.2020 20:30

Mathematics, 10.12.2020 20:30

Mathematics, 10.12.2020 20:30

Computers and Technology, 10.12.2020 20:30

Mathematics, 10.12.2020 20:30

History, 10.12.2020 20:30