Business, 11.12.2019 02:31 kiingbr335yoqzaxs

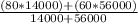

Carter co. sells two products, arks and bins. last year, carter sold 14,000 units of arks and 56,000 units of bins. related data are: unit selling price $120 unit variable cost $80 60 product unit contribution arks bins $40 20 80 what was carter co.'s variable cost of

a. $70

b. $64

c. $60

d. $140

Answers: 2

Another question on Business

Business, 22.06.2019 12:30

M. cotteleer electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. one of the components has an annual demand of 235 units, and this is constant throughout the year. carrying cost is estimated to be $1.25 per unit per year, and the ordering (setup) cost is $21 per order. a) to minimize cost, how many units should be ordered each time an order is placed? b) how many orders per year are needed with the optimal policy? c) what is the average inventory if costs are minimized? d) suppose that the ordering cost is not $21, and cotteleer has been ordering 125 units each time an order is placed. for this order policy (of q = 125) to be optimal, determine what the ordering cost would have to be.

Answers: 1

Business, 22.06.2019 15:20

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

Business, 22.06.2019 22:00

As a general rule, when accountants calculate profit they account for explicit costs but usually ignorea. certain outlays of money by the firm.b. implicit costs.c. operating costs.d. fixed costs.

Answers: 2

You know the right answer?

Carter co. sells two products, arks and bins. last year, carter sold 14,000 units of arks and 56,000...

Questions

Business, 20.11.2020 02:30

Mathematics, 20.11.2020 02:30

Mathematics, 20.11.2020 02:30

Mathematics, 20.11.2020 02:30

Mathematics, 20.11.2020 02:30

Mathematics, 20.11.2020 02:30

Mathematics, 20.11.2020 02:30

Mathematics, 20.11.2020 02:30

Biology, 20.11.2020 02:30

Biology, 20.11.2020 02:30