Business, 11.12.2019 06:31 glyptictriton9575

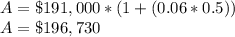

On november 1, 2021, new morning bakery signed a $191,000, 6%, six-month note payable with the amount borrowed plus accrued interest due sik months later on may 1, 2022 new morning bakery records the appropriate adjusting entry for the note on december 31, 2021. what amount of cash will be needed to pay back the note payable plus any accrued interest on may 1, 2022? (do not round your intermediate calculations.) ebook multiple choice $195,775. $196,730. $191,955 $191,000

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

After discussing the options, the strategic management team has agreed that the pod coffee idea works well with the company's mission statement and decides that the company should move forward in exploring the pod coffee idea. in order to make sure that the pod coffee idea is a good one, and to see if there are other potential future endeavors to pursue, you must analyze the market situation and formulate a strategy. your boss asks you to start working on the pod coffee idea. what is your first stepa. your first step is to formulate a strategy for how to market the pod coffee concept. b. your first step is to consult with your boss and find out what he thinks about the pod coffee idea. c. your first step is to do some research to find out what your competitors are doing. d. your first step is to analyze the organization's strengths, weaknesses, opportunities, and threats.

Answers: 2

Business, 22.06.2019 09:40

Boone brothers remodels homes and replaces windows. ace builders constructs new homes. if boone brothers considers expanding into new home construction, it should evaluate the expansion project using which one of the following as the required return for the project?

Answers: 1

Business, 22.06.2019 13:30

1. is the act of declaring a drivers license void and terminated when it is determined that the license was issued through error or fraud.

Answers: 2

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

You know the right answer?

On november 1, 2021, new morning bakery signed a $191,000, 6%, six-month note payable with the amoun...

Questions

Mathematics, 24.07.2021 21:40

Mathematics, 24.07.2021 21:40

Mathematics, 24.07.2021 21:40

English, 24.07.2021 21:40

English, 24.07.2021 21:40

Mathematics, 24.07.2021 21:40

English, 24.07.2021 21:40

Mathematics, 24.07.2021 21:40

Computers and Technology, 24.07.2021 21:40

Computers and Technology, 24.07.2021 21:40

Mathematics, 24.07.2021 21:40

Mathematics, 24.07.2021 21:40

Mathematics, 24.07.2021 21:40

Biology, 24.07.2021 21:40