Business, 12.12.2019 03:31 ReveenatheRaven2296

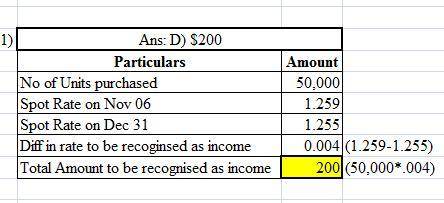

On november 6, 20x7, zucor corp. purchased merchandise from an unaffiliated foreign company for 50,000 units of the foreign company's local currency. on that date, the spot rate was $1.259. zucor paid the bill in full three months later when the spot rate was $1.258. the spot rate was $1.255 on december 31, 20x7. what amount should zucor report as a foreign currency transaction gain in its income statement for the year ended december 31, 20x7?

a. $0

b. $50

c. $

d. $200

Answers: 3

Another question on Business

Business, 22.06.2019 04:50

Problem 9-5. net present value and taxes [lo 1, 2] penguin productions is evaluating a film project. the president of penguin estimates that the film will cost $20,000,000 to produce. in its first year, the film is expected to generate $16,500,000 in net revenue, after which the film will be released to video. video is expected to generate $10,000,000 in net revenue in its first year, $2,500,000 in its second year, and $1,000,000 in its third year. for tax purposes, amortization of the cost of the film will be $12,000,000 in year 1 and $8,000,000 in year 2. the company’s tax rate is 35 percent, and the company requires a 12 percent rate of return on its films. required what is the net present value of the film project? to simplify, assume that all outlays to produce the film occur at time 0. should the company produce the film?

Answers: 2

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 3

Business, 22.06.2019 15:00

Magic realm, inc., has developed a new fantasy board game. the company sold 15,000 games last year at a selling price of $20 per game. fixed expenses associated with the game total $182,000 per year, and variable expenses are $6 per game. production of the game is entrusted to a printing contractor. variable expenses consist mostly of payments to this contractor.required: 1-a. prepare a contribution format income statement for the game last year.1-b. compute the degree of operating leverage.2. management is confident that the company can sell 58,880 games next year (an increase of 12,880 games, or 28%, over last year). given this assumption: a. what is the expected percentage increase in net operating income for next year? b. what is the expected amount of net operating income for next year? (do not prepare an income statement; use the degree of operating leverage to compute your answer.)

Answers: 2

Business, 22.06.2019 20:00

What is the difference between total utility and marginal utility? a. marginal utility is subject to the law of diminishing marginal utility while total utility is not. b. total utility represents the consumer optimum while marginal utility gives the total utility per dollar spent on the last unit. c. total utility is the total amount of satisfaction derived from consuming a certain amount of a good while marginal utility is the additional satisfaction gained from consuming an additional unit of the good. d. marginal utility represents the consumer optimum while total utility gives the total utility per dollar spent on the last unit.

Answers: 3

You know the right answer?

On november 6, 20x7, zucor corp. purchased merchandise from an unaffiliated foreign company for 50,0...

Questions

English, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Advanced Placement (AP), 01.03.2021 14:00

Advanced Placement (AP), 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Computers and Technology, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00

Mathematics, 01.03.2021 14:00