Business, 12.12.2019 03:31 CamFootball638

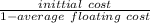

Yesteryear productions is considering a project with an initial costs of $318,000. the firm maintains a debt-equity ratio of .60 and has a flotation cost of debt of 5.2 percent and a flotation cost of equity of 11.1 percent. the firm has sufficient internally generated equity to cover the equity cost of this project. what is the initial cost of the project including the flotation costs?

Answers: 2

Another question on Business

Business, 22.06.2019 01:40

Select the word from the list that best fits the definition sometimes

Answers: 2

Business, 22.06.2019 09:30

What is the relationship among market segmentation, target markts, and consumer profiles?

Answers: 2

Business, 22.06.2019 20:40

Owns a machine that can produce two specialized products. production time for product tlx is two units per hour and for product mtv is four units per hour. the machine’s capacity is 2,100 hours per year. both products are sold to a single customer who has agreed to buy all of the company’s output up to a maximum of 3,570 units of product tlx and 1,610 units of product mtv. selling prices and variable costs per unit to produce the products follow. product tlx product mtv selling price per unit $ 11.50 $ 6.90 variable costs per unit 3.45 4.14 determine the company's most profitable sales mix and the contribution margin that results from that sales mix.

Answers: 3

Business, 23.06.2019 00:30

Which of the following emails should he save in this folder instead of deleting or moving it to another folder

Answers: 1

You know the right answer?

Yesteryear productions is considering a project with an initial costs of $318,000. the firm maintain...

Questions

Geography, 19.10.2020 15:01

Mathematics, 19.10.2020 15:01

History, 19.10.2020 15:01

Computers and Technology, 19.10.2020 15:01

Mathematics, 19.10.2020 15:01

Physics, 19.10.2020 15:01