Business, 12.12.2019 23:31 jadahilbun01

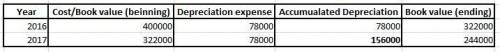

Cuso company purchased equipment on january 1, 2016, at a total invoice cost of $400,000. the equipment has an estimated salvage value of $10,000 and an estimated useful life of 5 years. what is the amount of accumulated depreciation at december 31, 2017, if the straight-line method of depreciation is used?

a. $80,000

b. $160,000

c. $78,000

d. $156,000

Answers: 1

Another question on Business

Business, 21.06.2019 13:30

List five words to describe your dominant culture. list five words to describe a culture with which you are not a member, have little or no contact, or have limited knowledge. can someone give me a example on how to answer this?

Answers: 1

Business, 21.06.2019 18:20

Which of the following housing decisions provides a person with both housing and an investment? a. selling a share in a cooperative. b. buying a single-family home. c. renting an apartment. d. subletting a condominium. 2b2t

Answers: 2

Business, 22.06.2019 16:40

Shawn received an e-mail offering a great deal on music, movie, and game downloads. he has never heard of the company, and the e-mail address and company name do not match. what should shawn do?

Answers: 2

Business, 22.06.2019 19:30

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

You know the right answer?

Cuso company purchased equipment on january 1, 2016, at a total invoice cost of $400,000. the equipm...

Questions

English, 28.10.2020 21:20

Physics, 28.10.2020 21:20

Biology, 28.10.2020 21:20

Chemistry, 28.10.2020 21:20

Mathematics, 28.10.2020 21:20

Mathematics, 28.10.2020 21:20

Chemistry, 28.10.2020 21:20

Mathematics, 28.10.2020 21:20

Mathematics, 28.10.2020 21:20

Mathematics, 28.10.2020 21:20

History, 28.10.2020 21:20

Mathematics, 28.10.2020 21:20

Mathematics, 28.10.2020 21:20

Mathematics, 28.10.2020 21:20