Business, 13.12.2019 00:31 Farhan54019

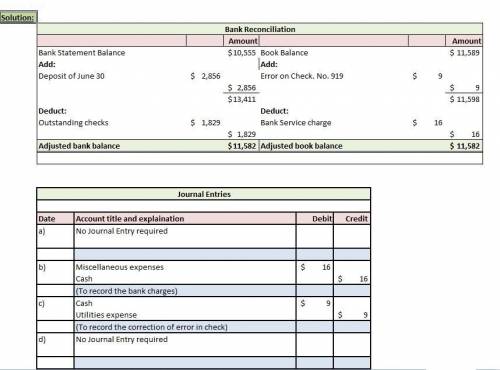

Del gato clinic deposits all cash receipts on the day when they are received and it makes all cash payments by check. at the close of business on june 30, 2017, its cash account shows an $11,589 debit balance. del gato clinic's june 30 bank statement shows $10,555 on deposit in the bank. outstanding checks as of june 30 total $1,829.the june 30 bank statement lists a $16 service charge. check no. 919, listed with the canceled checks, was correctly drawn for $467 in payment of a utility bill on june 15. del gato clinic mistakenly recorded it with a debit to utilities expense and a credit to cash in the amount of $476.the june 30 cash receipts of $2,856 were placed in the bank's night depository after banking hours and were not recorded on the june 30 bank statement. prepare the adjusting journal entries that del gato clinic must record as a result of preparing the bank reconciliation.

Answers: 1

Another question on Business

Business, 22.06.2019 07:10

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u.s. parent on bank deposits held in london d. interest received by a u.s. parent on a loan to a subsidiary in mexico e. principal repayment received by u.s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u.s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 19:20

Win goods inc. is a large multinational conglomerate. as a single business unit, the company's stock price is estimated to be $200. however, by adding the actual market stock prices of each of its individual business units, the stock price of the company as one unit would be $300. what is win goods experiencing in this scenario? a. diversification discount b. learning-curveeffects c. experience-curveeffects d. economies of scale

Answers: 1

Business, 23.06.2019 11:00

Match each event to its effect on the equilibrium interest rate and the amount of investment in the loanable funds market. higher interest rate, greater investment higher interest rate, less investment lower interest rate, less investment lower interest rate, greater investment immediate consumer gratification is no longer preferred by people. an efficient new source of energy effectively increases the return on owning a factory. a wave of retirees stops working and begins drawing on retirement savings.

Answers: 3

You know the right answer?

Del gato clinic deposits all cash receipts on the day when they are received and it makes all cash p...

Questions

Mathematics, 20.09.2020 18:01

Mathematics, 20.09.2020 18:01

Mathematics, 20.09.2020 18:01

Mathematics, 20.09.2020 18:01

Mathematics, 20.09.2020 18:01

Mathematics, 20.09.2020 18:01

Mathematics, 20.09.2020 18:01

Mathematics, 20.09.2020 18:01