Presented below is net asset information related to the skysong division, inc.

skysong divisio...

Presented below is net asset information related to the skysong division, inc.

skysong division

net assets

as of december 31, 2017

(in millions)

cash $64

accounts receivable 213

property, plant, and equipment (net) 2,608

goodwill 214

less: notes payable (2,603)

net assets $496

the purpose of the skysong division is to develop a nuclear-powered aircraft. if successful, traveling delays associated with refueling could be substantially reduced. many other benefits would also occur. to date, management has not had much success and is deciding whether a write-down at this time is appropriate. management estimated its future net cash flows from the project to be $430 million. management has also received an offer to purchase the division for $335 million. all identifiable assets’ and liabilities’ book and fair value amounts are the same.

required:

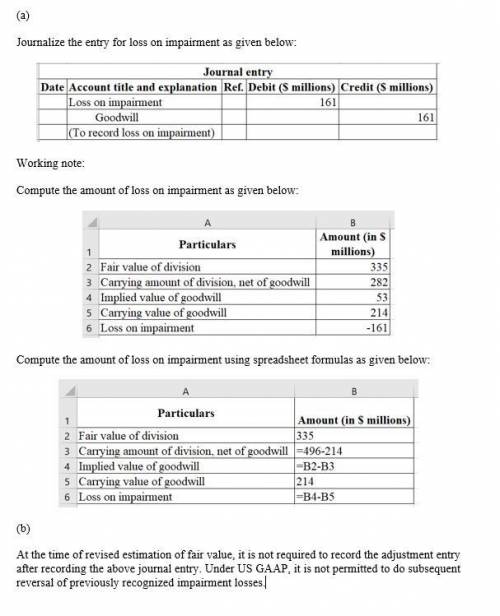

a. prepare the journal entry to record the impairment at december 31, 2017. (if no entry is required, select "no entry" for the account titles and enter 0 for the amounts.)

Answers: 3

Another question on Business

Business, 21.06.2019 16:10

Computing depreciation, net book value, and gain or loss on asset sale lynch company owns and operates a delivery van that originally cost $46,400. lynch has recorded straight-line depreciation on the van for four years, calculated assuming a $5,000 expected salvage value at the end of its estimated six-year useful life. depreciation was last recorded at the end of the fourth year, at which time lynch disposes of this van. compute the net bookvalue of the van on the disposal date.

Answers: 1

Business, 22.06.2019 18:40

Under t, the point (0,2) gets mapped to (3,0). t-1 (x,y) →

Answers: 3

Business, 22.06.2019 20:00

On january 1, year 1, purl corp. purchased as a long-term investment $500,000 face amount of shaw, inc.’s 8% bonds for $456,200. the bonds were purchased to yield 10% interest. the bonds mature on january 1, year 6, and pay interest annually on january 1. purl uses the effective interest method of amortization. what amount (rounded to nearest $100) should purl report on its december 31, year 2, balance sheet for these held-to-maturity bonds?

Answers: 1

Business, 22.06.2019 22:00

Miami incorporated estimates that its retained earnings break point (bpre) is $21 million, and its wacc is 13.40 percent if common equity comes from retained earnings. however, if the company issues new stock to raise new common equity, it estimates that its wacc will rise to 13.88 percent. the company is considering the following investment projects: project size irr a $4 million 14.00% b 5 million 15.10 c 4 million 16.20 d 6 million 14.20 e 1 million 13.42 f 6 million 13.75 what is the firm's optimal capital budget?

Answers: 3

You know the right answer?

Questions

Mathematics, 16.12.2020 23:50

Health, 17.12.2020 01:00

Chemistry, 17.12.2020 01:00

Mathematics, 17.12.2020 01:00

Biology, 17.12.2020 01:00

English, 17.12.2020 01:00

Social Studies, 17.12.2020 01:00