Business, 14.12.2019 02:31 sadiesnider9

Bonita company produces golf discs which it normally sells to retailers for $7 each. the cost of manufacturing 23,600 golf discs is: materials $ 12,744 labor 36,344 variable overhead 24,308 fixed overhead 48,144 total $121,540 bonita also incurs 7% sales commission ($0.49) on each disc sold. mcgee corporation offers gruden $4.90 per disc for 5,100 discs. mcgee would sell the discs under its own brand name in foreign markets not yet served by bonita. if bonita accepts the offer, its fixed overhead will increase from $48,144 to $52,714 due to the purchase of a new imprinting machine. no sales commission will result from the special order.

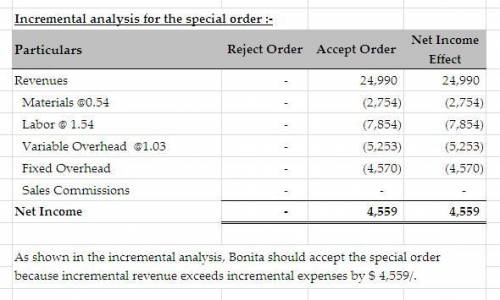

(a) prepare an incremental analysis for the special order. (enter negative amounts using either a negative sign preceding the number e. g. -45 or parentheses e. g. ( reject order accept order net income increase (decrease) revenues $ $ $ materials labor variable overhead fixed overhead sales commissions net income $ $ $

(b) should bonita accept the special order? bonita should the special order .

Answers: 1

Another question on Business

Business, 22.06.2019 08:30

What is the key to success in integrating both lethal and nonlethal activities during planning? including stakeholders once a comprehensive operational approach has been determined knowing the commander's decision making processes and "touch points" including stakeholders from the very beginning of the design and planning process including the liaison officers (lnos) in all the decision points?

Answers: 1

Business, 22.06.2019 11:40

The following pertains to smoke, inc.’s investment in debt securities: on december 31, year 3, smoke reclassified a security acquired during the year for $70,000. it had a $50,000 fair value when it was reclassified from trading to available-for-sale. an available-for-sale security costing $75,000, written down to $30,000 in year 2 because of an other-than-temporary impairment of fair value, had a $60,000 fair value on december 31, year 3. what is the net effect of the above items on smoke’s net income for the year ended december 31, year 3?

Answers: 3

Business, 22.06.2019 15:50

Singer and mcmann are partners in a business. singer’s original capital was $40,000 and mcmann’s was $60,000. they agree to salaries of $12,000 and $18,000 for singer and mcmann respectively and 10% interest on original capital. if they agree to share remaining profits and losses on a 3: 2 ratio, what will mcmann’s share of the income be if the income for the year was $15,000?

Answers: 1

You know the right answer?

Bonita company produces golf discs which it normally sells to retailers for $7 each. the cost of man...

Questions

Spanish, 27.11.2019 06:31

Spanish, 27.11.2019 06:31