Business, 14.12.2019 02:31 ryleepretty

American exploration, inc., a natural gas producer, is trying to decide whether to revise its target capital structure. currently it targets a 50-50 mix of debt and equity, but it is considering a target capital structure with 70% debt. american exploration currently has 6% after-tax cost of debt and a 12% cost of common stock. the company does not have any preferred stock outstanding.

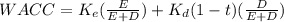

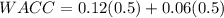

a. what is american exploration's current wacc?

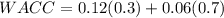

b. assuming that its cost of debt and equity remain unchanged, what will be american exploration's wacc under the revised target capital structure?

c. do you think shareholders are affected by the increase in debt to 70%? if so, how are they affected? are the common stock claims riskier now?

d. suppose that in response to the increase in debt, american exploration's shareholders increase their required return so that cost of common equity is 16%. what will its new wacc be in this case?

e. what does your answer in part d suggest about the tradeoff between financing with debt versus equity?

Answers: 1

Another question on Business

Business, 21.06.2019 22:00

The market yield on spice grills' bonds is 15%, and the firm's marginal tax rate is 33%. what is their shareholders' required return if the equity risk premium is 4%?

Answers: 1

Business, 21.06.2019 22:40

Lincoln company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. in the current year, $400,000 was spent on project one, and it was 55 percent likely to succeed, $600,000 was spent on project two, and it was 65 percent likely to succeed, and $900,000 was spent on project three, and it was 75 percent likely to succeed. in converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced? a. $180,000b. $380,000c. $720,000d. $900,000

Answers: 3

Business, 22.06.2019 04:30

The lee family is looking to buy a house in one of two suburban areas just outside of a major city, and air quality is a top priority for them. overall air quality is calculated by taking measures in 100 locations within each suburb and then calculating a measure of central tendency. in one suburb, there is a major bus station that creates very poor air quality at its location but has no impact in the surrounding parts of the suburb. in this situation, which measure of overall suburb air quality would be most useful?

Answers: 3

Business, 22.06.2019 19:50

Statistical process control charts: a. indicate to the operator the true quality of material leaving the process. b. display upper and lower limits for process variables or attributes and signal when a process is no longer in control. c. indicate to the process operator the average outgoing quality of each lot. d. display the measurements on every item being produced. e. are a graphic way of classifying problems by their level of importance, often referred to as the 80-20 rule.

Answers: 2

You know the right answer?

American exploration, inc., a natural gas producer, is trying to decide whether to revise its target...

Questions

History, 14.01.2021 16:50

Physics, 14.01.2021 16:50

English, 14.01.2021 16:50

English, 14.01.2021 16:50

Mathematics, 14.01.2021 16:50

Geography, 14.01.2021 16:50

English, 14.01.2021 16:50